Arguably, everyone has ever found themselves stuck financially, whether at home or in business. Sometimes bills pile up, while others come in unexpectedly, forcing people, especially those who depend on monthly salaries, to resort to loans to remain afloat.

To help people in times of emergencies, the Co-operative Bank of Kenya (Co-op Bank) has rolled out various products that meet the needs of diverse customers.

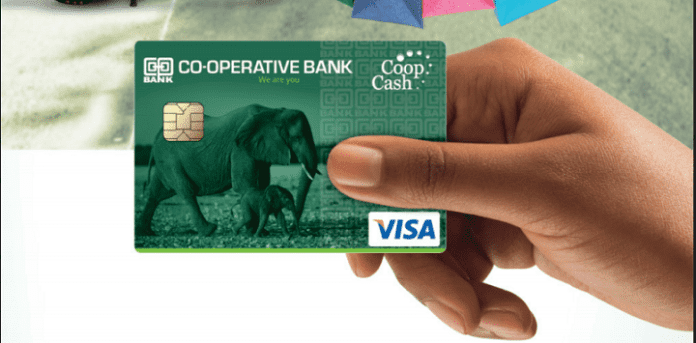

A good example is the Co-op Bank credit card designed to offer instant loans to customers without visiting the bank. The credit card is not linked to any bank account; the bank assigns loan limit to customers, accessible only via the card.

Customers can access the money by withdrawing cash at any Visa-branded ATM, paying for goods & services in a physical outlet where Visa cards are accepted, or paying for goods and services online.

The good news about the Co-op Bank credit card is that all payment transactions are free. The only amount that is deducted from the card is the cost of the item or service a customer is paying for.

However, charges are incurred when withdrawing cash using the card. The commission-based charges are deducted up-front from the available card limit.

Additionally, no interest is charged to customers who repay their loans on time. Co-op Bank gives the card users an interest-free period of up to 49-days, if they clear their outstanding balance on or before the statement date.

“If you’re not able to repay the full loan at once, you may repay the loan in installments. The bank will charge you a monthly interest rate on the outstanding amount until you clear the outstanding balance,” Co-op Bank says.

How To Apply For A Co-Op Credit Card:

You don’t need a Co-op Bank account to apply for a Credit Card. You can apply at any branch countrywide with your ID, 6 months bank statement, and the card processing fee.

Below are the options available depending on your income:

To avoid fraud and keep your card safe:

- Only shop on secure websites.

- Do NOT share with anyone your Card Number, PIN, CVV (the 3-digit number at the back of your card) or the OTP’s (one-time passwords) you receive when transacting online.

ALSO READ: Make free transactions with Co-op Bank prepaid card: how to get started