Kenya’s real estate sector closed 2025 in a position of cautious strength, marked by stabilising macroeconomic conditions, selective investor confidence, and a clear shift from speculative expansion to disciplined execution. This is according to the Kenya Market Update H2 2025 released by Knight Frank Kenya, which paints a picture of a market adapting to both economic realities and political timelines ahead of the 2027 general elections.

Economic Stabilisation Is Reshaping Development Strategy

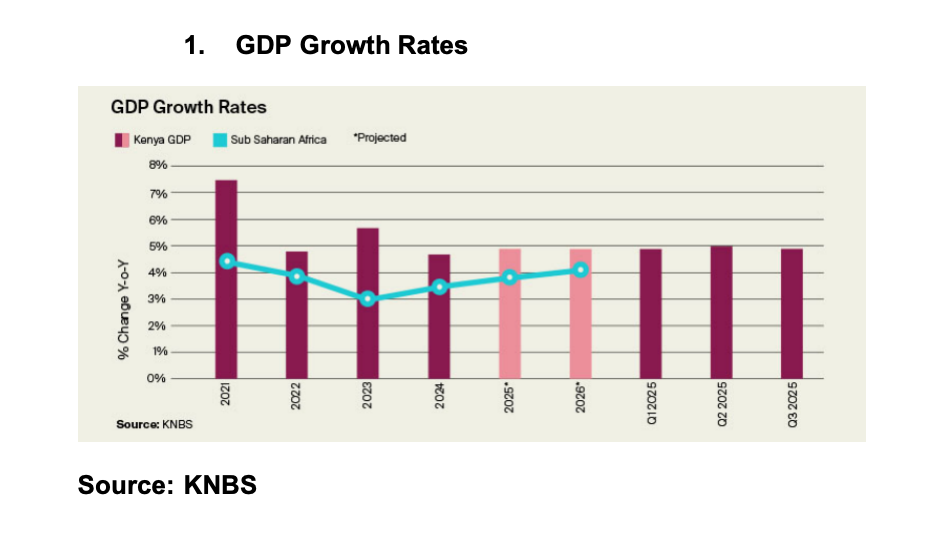

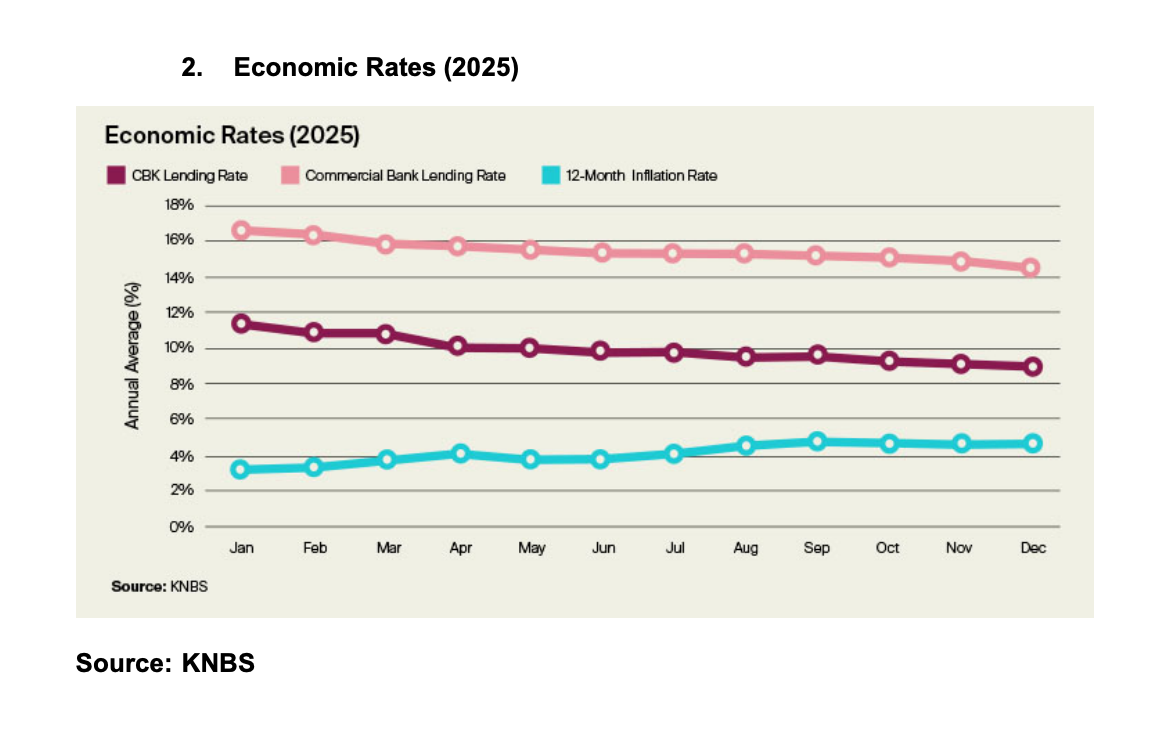

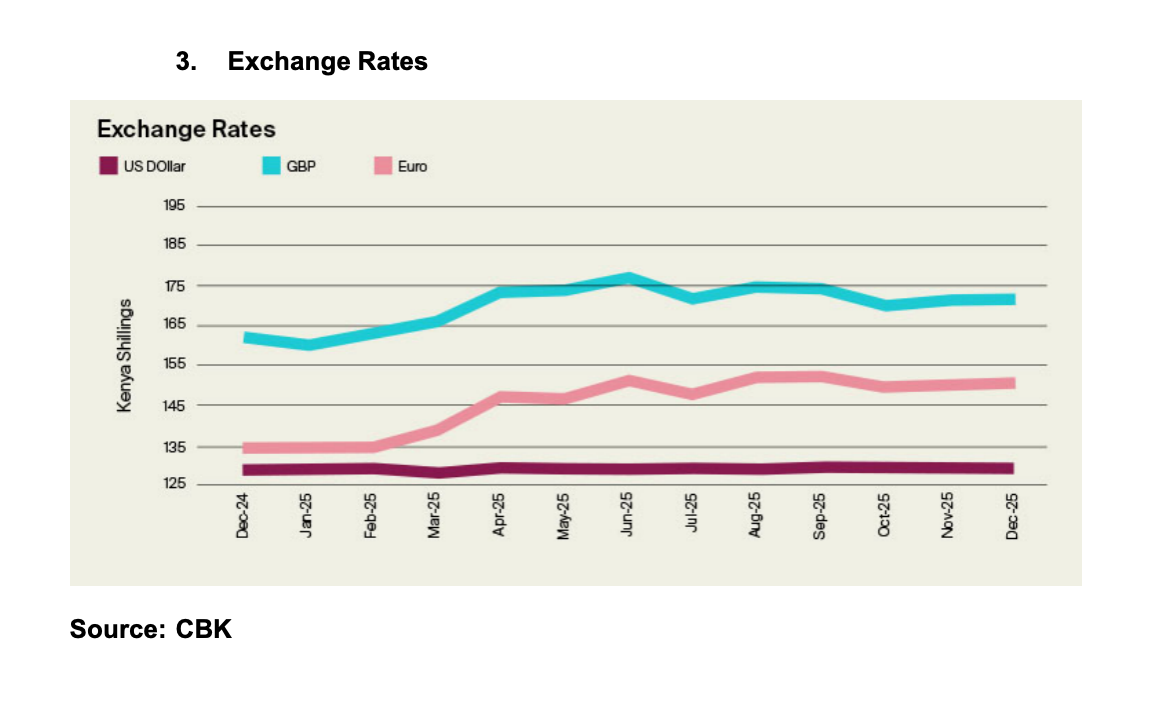

Kenya’s economy is estimated to have grown by 4.9% in 2025, with a similar growth forecast for 2026. Inflation remained within the Central Bank of Kenya’s target range, the shilling stabilised, and lending rates declined. These factors provided a firmer foundation for long-term planning.

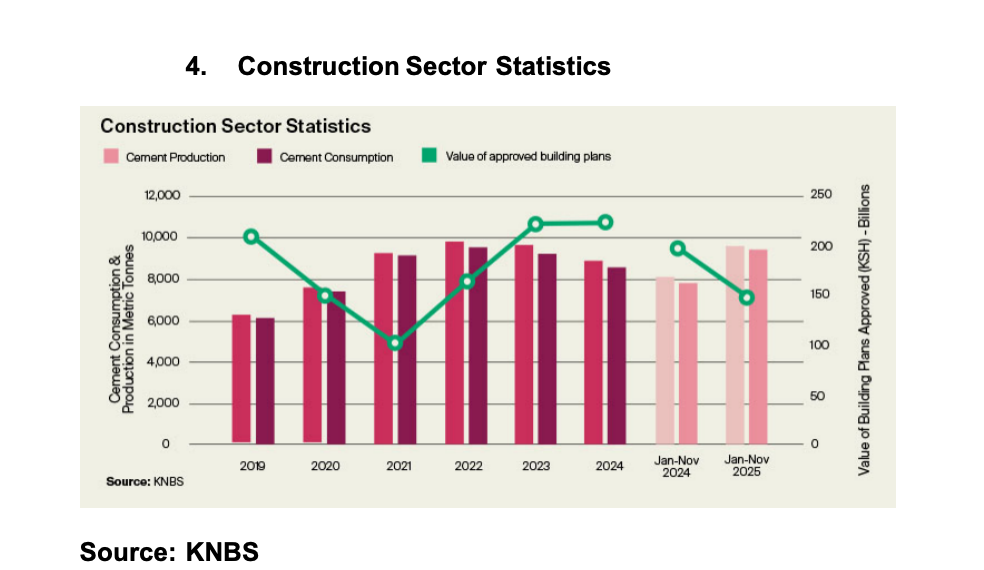

However, developers responded conservatively. The value of approved building plans in Nairobi fell by approximately 24% year-on-year, signalling a strategic pause. Rather than launching new projects, developers focused on completing existing stock, a move that reflects maturity rather than distress.

This consolidation phase suggests a market prioritising absorption and cash flow discipline over aggressive expansion.

Infrastructure Progress Relies Increasingly on Private Capital

Infrastructure delivery in the second half of 2025 was largely driven by Public-Private Partnerships and foreign capital. A key example is the USD 863 million Nairobi–Nakuru–Mau Summit highway, now progressing under a PPP model.

Policy clarity also improved, with court rulings strengthening investor protections and planning frameworks increasingly supporting urban densification. Nonetheless, a widening public financing gap highlights the growing importance of private capital in delivering Kenya’s infrastructure ambitions.

Office Market Recovery Driven by Grade A Demand

Nairobi’s prime office market showed clear signs of recovery. Occupancy rates rose to 81.58% by December 2025, driven by strong uptake of Grade A developments such as Purple Tower and The Mandrake.

Rents remained stable at approximately USD 1.20 per square foot per month, while prime yields held firm at between 8% and 9%. Flexible workspaces continued to expand, though the closure of non-core outlets underscored the importance of location, operational efficiency, and sustainable business models.

Retail Sector Shifts Toward Community-Centric Formats

Kenya’s retail market remained resilient despite ongoing digital disruption. Major retailers, including Naivas and Carrefour, led physical expansion strategies focused on neighbourhood and community malls.

Footfall remained strong, and the development pipeline is increasingly oriented toward mixed-use and convenience-driven projects. Proposed developments such as the Talanta Sports City mall reflect a broader pivot toward value-based retail that integrates leisure, accessibility, and daily consumer needs.

Residential Demand Moves Toward Integrated Living

Prime residential price growth moderated to 6.17% in 2025, signalling a more balanced market. Buyer preferences are increasingly shifting toward secure, amenity-rich, master-planned environments.

Large-scale developments such as Tatu City and Tilisi continued to attract demand, while high-end apartment projects in Westlands reflected sustained appetite for quality urban living. The emphasis is clearly on lifestyle, infrastructure, and long-term value rather than speculative capital gains.

Businessman Shahbal: How I lost Sh450 million in Affordable Housing Project

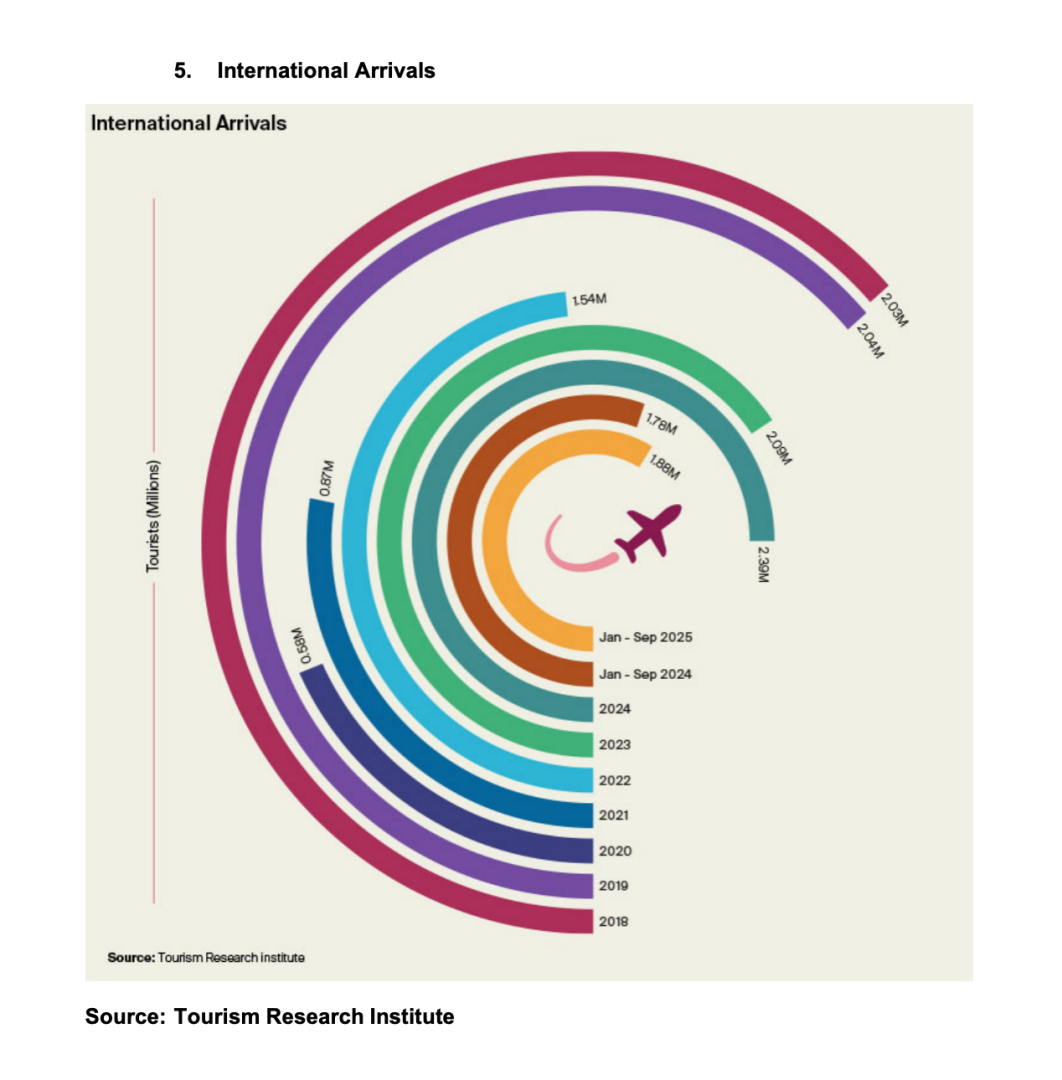

Hospitality and Tourism Record Strong Momentum

Kenya’s hospitality sector benefited from a 9.5% increase in international arrivals, supported by expanded international airlift. Landmark developments, including the opening of the Ritz-Carlton Masai Mara, reinforced the country’s luxury tourism appeal.

At the coast, the operationalisation of the Mombasa Commuter Rail boosted accessibility, pushing hotel occupancies above 85% in December 2025. The data points to renewed confidence in tourism-linked real estate assets.

Industrial and Data Infrastructure Attract Major Investment

The industrial segment emerged as one of the strongest performers. Special Economic Zones, particularly Tatu City, attracted over KES 65 billion in new foreign direct investment commitments.

Alternative assets also gained prominence. Data centre developments, including Airtel’s Nxtra facility, reinforced Kenya’s positioning as East Africa’s digital infrastructure hub, supported by connectivity, regional demand, and improving policy alignment.

2026 Outlook: Discipline Over Speculation

Looking ahead, the outlook for 2026 is defined by caution, quality, and execution. Stable macroeconomic indicators provide confidence, but election-related uncertainty is expected to keep many investors in a wait-and-see posture.

Growth is likely to concentrate in asset classes supported by targeted financing and policy alignment, including affordable housing, prime office space, Special Economic Zones, and completed income-generating stock. Speculative developments without clear demand fundamentals are expected to slow further.

The message from the market is clear: Kenya’s real estate sector is no longer rewarding speed or scale alone. It is rewarding discipline, quality, and strategic patience.

For investors, developers, and policymakers alike, the next phase will be less about expansion and more about stewardship—deploying capital responsibly, aligning with real demand, and building assets that can withstand both economic cycles and political transitions.

Download the Kenya Market Update H2 2025 full report HERE

Did you love the story? You can also share YOUR story and get it published on Bizna Click here to get started.