Africa in the past decade has been one of the leading continents in Foreign direct investments. ( FDI ) most of which has mainly gone to infrastructure and the financial sector. Billions of dollars have been injected into the continent to not only build a robust financial industry in the continent but also to support key development agendas for the respective countries. Let us review the top Banks in Africa today

“Home to over 1.3 billion people, the African continent is home to almost 17% of the world’s total population. According to the United Nations, Africa is home to 54 countries. Each of them is unique and diverse, presenting their own cultural and economic differences. In terms of banking, the region as a whole has various unique players that cater to its large population.”

The Continental Banking industry Overview Post Covid – 19

How did Africa’s leading banks fare in the past year, a year defined by the Covid-19 pandemic which led to massive disruptions to businesses, volatility in commodity prices and a shift in consumption patterns and the way people paid for goods and services? The short answer is that they continued on their positive growth trajectory, and they nearly all remained profitable. Across the leading banks, profits have fallen hard compared to the 2019 ranking, partly driven by increased provision for non-performing loans as banks and regulators prepared for giant impacts on businesses and other borrowers from the global health pandemic.

All the big South African banks put billions of rand into reserves to cope with non-performing loans and these could be unwound as business risks return to more normal levels. Non-performing loans are likely to increase because of the economic turmoil and contraction, although this may not be as severe as first feared. Banks in Nigeria, for example, exposed to the oil and gas sector, which saw a large fall in its price at the outset of the pandemic, are hedged and the price has since bounced back to acceptable levels from a risk perspective.

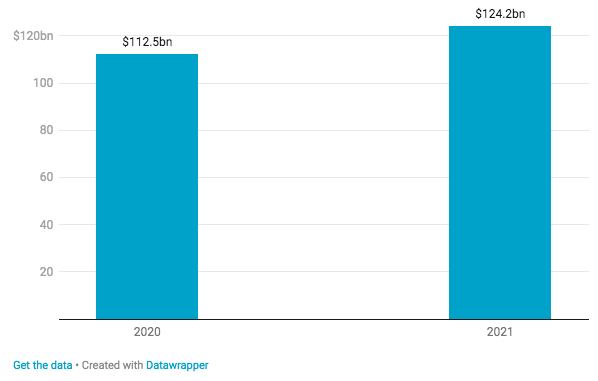

Totting up the totals for this year’s top 100 banks shows that total tier 1 capital was up 10.9% to $124.5bn from S112.2bn in 2020, which in turn was a 10.5% climb from 2019. However, the total net profit was $14.4bn, a big 31% fall from last year’s $20.8bn. Africa’s top bank, Standard Bank, said the 43% decline in group headline earnings in the year to December 2020 was “driven by a significant increase in impairment charges”.

The total capitalisation of the Top 100 Banks in Africa is up 10.9% from 2020

Below is a list of the top 25 African banks according to assets. African banking can be roughly split into two systems – sub-Saharan Africa and North Africa. The Top 25 listing is dominated by the ‘big four’ South African financial giants: Standard Bank, ABSA, Nedbank and FirstRand Group. The new generation of Nigerian banks, led by Access Bank, Guaranty Trust Bank, and Zenith Bank, are emerging as dynamic players in regional markets.

| Rank | Bank | Country Origin | Total Assets, US$bn | Capital ( $M ) |

| 1 | Standard Bank Group | South Africa | 184.518 | 11,160 |

| 2 | Absa Group | South Africa | 97.241 | 7,746 |

| 3 | FirstRand | South Africa | 94.144 | 7,611 |

| 4 | Nedbank Group | South Africa | 80.110 | 7,268 |

| 5 | National Bank of Egypt | Egypt | 50.665 | 5,567 |

| 6 | Attijariwafa Bank | Morocco | 40.026 | 5,463 |

| 7 | Banque Exterieur d’Algerie (BEA) | Algeria | 34.373 | 5,000 |

| 8 | Investec Bank | South Africa | 31.335 | 4,718 |

| 9 | Banque Misr | Egypt | 29.436 | 3,493 |

| 10 | Credit populaire du Maroc (Groupe Banque Centrale Populaire) | Morocco | 27.662 | 3,050 |

| 11 | Banque Marocaine du Commerce (BMCE) | Morocco | 24.239 | 3,015 |

| 12 | Banque Nationale d’Algerie (BNA) | Algeria | 21.125 | 2,638 |

| 13 | Bank Muscat | Oman | 18.774 | 2,503 |

| 14 | Libyan Arab Foreign Bank (LAFB) | Libya | 18.000 | 1,967 |

| 15 | Gumhouria Bank | Libya | 17.513 | 1,899 |

| 16 | First Bank of Nigeria | Nigeria | 17.393 | 1,577 |

| 17 | Ecobank Group (Ecobank Transnational Incorporated (ETI)) | Togo | 17.162 | 1,565 |

| 18 | Al Baraka Banking Group | Bahrain | 17.154 | 1,553 |

| 19 | Commercial International Bank (CIB) | Egypt | 14.189 | 1,463 |

| 20 | Zenith Bank | Nigeria | 14.147 | 1,417 |

| 21 | KCB Bank Group | Kenya | 12.032 | 1,381 |

| 22 | Banque de l’Agriculture et du Développement Rural (BADR) | Algeria | 12.010 | 1,346 |

| 23 | United Bank for Africa | Nigeria | 11.901 | 1,329 |

| 24 | Equity Bank Group | Kenya | 11.204 | 1,302 |

| 25 | National Societe Generale Bank | Egypt | 10.376 | 998 |