Absa Bank Kenya has announced that it will invest more than KES 2 billion this year in technological upgrades that significantly improve customers’ banking experiences.

Part of this investment has gone toward the launch of an online account opening platform, which allows customers to in just a few minutes open Absa accounts remotely via the internet or smartphone at any time, from any location, and begin transacting immediately without visiting a branch.

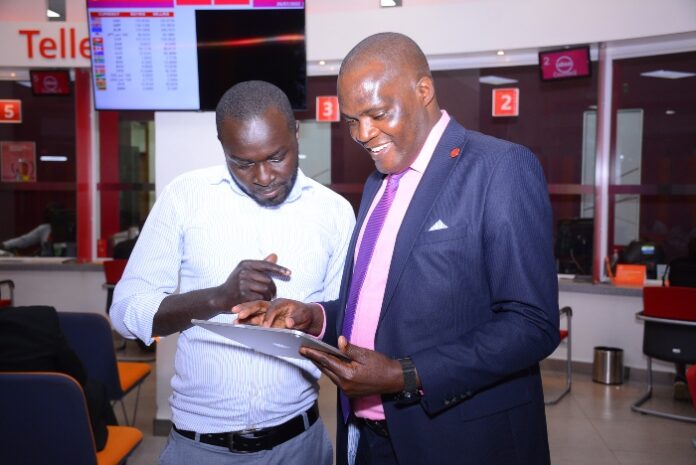

Absa Bank Kenya Managing Director Jeremy Awori stated the online account opening demonstrates the bank’s commitment to continue investing in digitally led innovative solutions that are aligned with their evolving demands and expectations, as most of them prefer to transact on the go.

Absa Bank Kenya, Visa partner to launch domestic and cross-border remittance service

“This introduction is inspired in many ways by customers’ and businesses’ desire for a simple yet efficient banking experience. The online account opening is thus a real game changer for customers and the market, as it will provide customers with a new level of ease by eliminating the need for applicants to fill out paper applications or provide multiple documents when opening an account,” Mr Awori explained.

He added: “These digital enhancements fuel Absa’s digital innovation strategy that aims to enhance customers’ experiences and promote financial access.”

Customers who open a new account will have the option of accessing the newly introduced Absa Digital Savings Account, which has an introductory interest rate of 7% per annum. The account earns daily interest and pays it out quarterly. Customers can also deposit funds quickly after activating their accounts and securely access their balance at any time and from any location.

As part of its ongoing digital transformation, the bank invested up to KES1.6 billion in 60 different technology projects last year, including digital loan top-ups in 15 minutes and Abby, a 24/7 WhatsApp banking virtual assistant.

The introduction of self-service online account opening is another example of how the bank brings possibilities to life for customers and stakeholders by collaborating with them to get things done, as highlighted in the bank’s new campaign, Pamoja Tunawiri.