However, agricultural productivity still remains far from developed world standards. Over 90% of agriculture depends on rainfall, with no artificial irrigation aid. The techniques used to cultivate the soil are still far behind what has been adopted in Asia and the Americas, lacking not only irrigation but also fertilisers, pesticides and access to high-yield seeds. Agriculture in Africa also experiences basic infrastructural problems such as access to markets and financing.

Singapore is proving to be an engaged ally in the process of changing this reality. Some big players in the agricultural sector with their headquarters in Singapore, are investing heavily in Africa. Technology and skills are being transferred to smallholder farmers and the large-scale producers are cooperating, playing a fair game that will help develop the sector and make it more sustainable.

Agriculture in Africa: An overview

In Africa, agriculture accounts for two-thirds of livelihoods and food accounts for two-thirds of the household budgets of poor people. It makes up a very important part of the lives of African people, but despite this, it receives very little attention from the governments.

The low productivity levels of agriculture in Africa have resulted in a worrisome scenario: it does not meet the growing demand for food from urban centres. The region is increasingly dependent on food imports. For a continent with such a vast area, a booming young population and a tropical climate, it is surprising that Africa is not a net exporter of agricultural products. In the 1970s, Africa provided 8% of the world’s total agricultural exports. Today this number has dropped to a negligible 2%.

Africa spent US$35bn on food imports (excluding fish) in 2011, only 5% of it related to trading within the continent. An increase in productivity, matched with the right set of policies and investments, could revert this situation. Africa could replace these imports with their produce, which would in turn reduce poverty, enhance food and nutrition security, and provide sustainable growth to the respective societies.

A broader economic transformation is necessary to shift the current paradigm facing agriculture in Africa. In most of the cases, urbanization and economic growth have resulted in new opportunities for local agricultural producers. However, in Africa, this share of the market mainly belongs to foreign companies. Imports of food staples have been rising sharply, and domestic agriculture has so far failed to increase supply in response. Raising productivity in agriculture is vital to transformative growth, not just because it has the potential to expand markets by displacing imports, but also because agricultural growth is twice as effective in reducing poverty as growth in non-agricultural sectors.

How does agricultural development trigger economic growth?

Agricultural growth was the precursor to the industrial revolutions that spread across the temperate world, from England in the mid-18th century, to Japan in the late 19th century. At that time, a better understanding of the use of soil and techniques, such as irrigation, use of horsepower in the fields, and seed selection, improved crop yields. Consequently, livestock could be better fed during winter times, increasing the size of herds. These changes in agriculture made it possible to feed all the people attracted to the industrial centres as factory workers, triggering the Industrial Revolution and leading to higher economic growth.

More recently, we see examples of economic transformation linking better agricultural productivity to industrial growth in countries such as China, India, and Vietnam.

What is it about agriculture in Africa?

In the modern world, the cycle of economic growth resulting from agricultural development is somewhat more complex than what was observed at the beginning of the Industrial Revolution. First, as income grows, demand for non-food items grows while demand for most agricultural products decreases as a percentage of total consumer spending. Consumers start spending more money on non-essential products, while spending on food flattens. This imbalance increases the price of non-food items relative to food prices, causing resources like labour and capital to move from agriculture to more remunerative uses in other sectors.

As economic development unfolds, education levels grow across populations. The formal education and complex skills acquired through schooling are largely required in the non-agricultural sectors. With increasing education levels, an economy sees its working force in the fields being replaced by machines and a better use of the soil and resources. Large-scale corporate farms replace small-scale family farms. In the long run, the value of farm production typically grows slower than does aggregate income, or GDP.

Over time, the agricultural sector gives up land for urban expansion, industrial and services sectors use (including recreational and tourism activities), and increasingly also for purposes of environmental conservation. That is, in a nutshell, the history of Singapore. The lack of land, however, resulted in an extreme version of the scenario and all the output of the agricultural sector was replaced by imports.

In larger countries, these shifts can reach a balance, with a highly productive agricultural sector that provides food to a thriving urban area.

Agricultural Growth in Africa

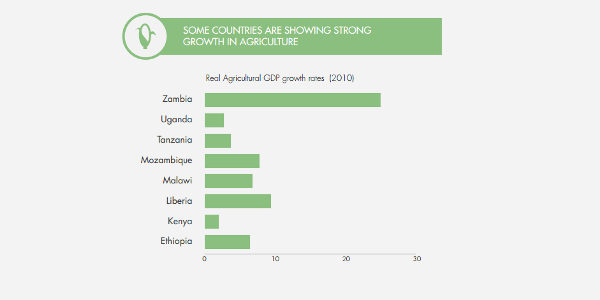

The reality of agricultural development in Africa is still far from ideal. In sub-Saharan Africa, the growth rate of agricultural GDP per capita was close to zero during the early 1970s, reaching negative figures in some years. This changed in the 1980s, when agricultural GDP growth reached 2.3% per year, increasing to 3.8% a year from 2000 to 2005. However, this increment was mainly due to an expansion in farmland, and not in agricultural productivity. African farm yields are among the lowest in the world. However, some countries have experienced strong GDP growth in agriculture, such as Zambia, Liberia, Mozambique and Ethiopia.

Although there is a strong link between agricultural growth and decreases in poverty, the connection is not that simple. An example of this is Zambia, which experienced a vast increase in maize yields from 2006 to 2011, but did not see a reduction in poverty. Underlying inequalities and government policy explain the discrepancy. The gains in productivity in Zambia were mainly attributed to large-scale fertiliser subsidies to large farms. Small farms, with areas below one hectare, received only an average of 7% of the subsidy.

On the positive side, there are two examples where agricultural growth did drive a decrease in poverty – Ethiopia and Rwanda. According to the World Bank, poverty in Ethiopia dropped by 33% since 2000, with an agricultural GDP growth of nearly 10% per year being the main driver.

Rwanda’s strategy was to focus its production on staple crops. While export crops typically have higher value, staple crops have a larger potential to replace imported food, which points to a promising avenue for growth that reduces poverty.

How can African countries improve their agricultural sector and use it as an engine of economic growth? The strategy will depend on each individual country, but there are a few common measures that, when put together, certainly increase the chances of a country igniting a virtuous circle of growth fueled by agriculture.

Increasing productivity

Agricultural productivity is related to a range of factors. The lack of irrigation is an obvious example. Only 5% of the cultivated land in Africa makes use of irrigation, with most of the farmers depending on rainfall. In comparison in Asia, 38% of the arable land is under irrigation.

Furthermore, soil health is a challenge. The average farmer in Ghana uses only 7.4kg of fertiliser per hectare, while in South Asia fertiliser use averages more than 100kg per hectare. Unsurprisingly, output per hectare in Africa falls far below the levels registered in other parts of the world. When farmers plant the same fields without using fertilisers, they literally mine the soil: an estimated eight million tonnes of nutrients are depleted annually in Africa.

The cost of fertilisers is part of the problem. Farmers in Africa face some of the world’s highest fertiliser prices, and not just in landlocked countries where transport costs are higher, like Burundi and Uganda. Farmers in Nigeria and Senegal pay three times more than their counterparts in Brazil and India. Some countries, like Ghana and Malawi, have thrown money at fertiliser subsidies in flush years only to cut back when budgets tighten. Subsidised fertiliser intended for smallholders has often been resold at market rates with middlemen pocketing the profit. Nigeria’s system became so corrupt that in 2012, the agriculture minister, Akinwumi Adesina, estimated that as little as 11% of subsidised fertiliser was actually getting to small farmers at the subsidised price.

Pesticides are another element that, if correctly used, can improve crop yield without environmental damage. This method has been increasingly adopted in the past decade across Africa in an indiscriminate fashion. The lack of education on which types and quantities of pesticide are the best for each crop, and the absence of government control, have led to its excessive use and consequent environmental contamination and human health problems.

Access to quality seeds has also a long way to go in Africa. Experts at the Integrated Seed Sector Development (ISSD) Africa seminar in Kenya pointed out that small-scale farmers in sub-Saharan Africa are unable to get full information and access to good seeds. The circulation of fake seeds is a major problem in Kenya, which hinders the transformation of the agricultural sector. Africa needs a well-functioning, market-driven seed system and research scientists working with small-scale farmers to improve their seeds. The increasing degree of climate change also aggravates the situation. Aiming for improved seed varieties will help crops resist or withstand droughts and flooding, challenges that are becoming alarmingly common.

Some significant improvements have been achieved by AGRA. The Alliance for a Green Revolution in Africa was founded in 2006 through a partnership between the Rockefeller Foundation and the Bill & Melinda Gates Foundation and has been helping millions of smallholder farmers in Africa. AGRA has supported more than 400 projects, including efforts to develop and deliver better seeds, increase farm yields, improve soil fertility, upgrade storage facilities, improve market information systems, strengthen farmers’ associations, expand access to credit for farmers and small suppliers, and advocate for national policies that benefit smallholder farmers. Today AGRA collaborates with more than 100 seed companies, representing about a third of the market. They produced about 125,000 tonnes of improved seed in 2015 – up from 26,000 tonnes in 2010.

In Rwanda, the One Acre Fund charity provides its clients with high-yield seeds, fertiliser, know-how and credit, which many times is the deal-break point. The increased productivity of high-yield seeds usually comes with a downpoint: the plants grown from them do not produce seeds of the same sort. Hence, small farmers frequently struggle to find financing to buy seeds for the next crop.

In 2015, One Acre Fund’s large network of instructors, farmers themselves, taught some 305,000 East African smallholders, developing skills such as carefully spacing seeds to maximise productivity and applying fertiliser optimally.

Lack of subsidies

Agriculture subsidies are an important factor of imbalance in the international market. Although Africa has one of the lowest costs of production of agricultural commodities in the world, it loses competitiveness in the international market as wealthier countries subsidise their farmers, sometimes to the extent that the selling price of crops is lower than the production cost.

That is the reality of cotton farmers in West Africa. The United States, the world’s largest cotton producer, paid its cotton farmers $32.9bn to grow their crops between 1995 and 2012. US farmers are subsidised so they produce more cotton than they would otherwise, lowering the global price.

Members of the Organisation for Economic Cooperation and Development (OECD) spent a total of $258bn subsidising agriculture in 2013. As a consequence, wealthy nations inflate their agricultural outputs to an artificial level, frequently flooding the commodities market and bringing prices down. This creates unfair competition in the global market, where the most affected (negatively) are the small farmers in the poorest countries, where government subsidies are non-existent.

Since more than one-third of the GDP of most African countries is directly related to the agricultural sector, these countries may be even more vulnerable to the effects of subsidies. They generate an indirect impact on reducing the income available to invest in rural infrastructure such as health, safe water supplies and electricity for the rural poor. Struggling to survive, many farmers migrate from rural to urban areas in search of alternative economic opportunities.

An important milestone on abolishing subsidies was achieved in the World Trade Organisation meeting held in Nairobi, in December of 2015. Developed countries have committed to removing export subsidies immediately, except for a handful of agricultural products, and developing countries will do so by 2018. Developing members will keep the flexibility to cover marketing and transport costs for agriculture exports until the end of 2023, and the poorest and food-importing countries will enjoy additional time to cut export subsidies.

The decision contains disciplines to ensure that other export policies are not used as a disguised form of subsidy. These disciplines include terms to limit the benefits of financing support to agriculture exporters, rules on state enterprises engaging in agriculture trade, and disciplines to ensure that food aid does not negatively affect domestic production. Developing countries are given longer time to implement these rules. These measures will hopefully make the global market more balanced (creating greater equity) and improve the competitiveness of smallholder farmers in Africa.

Mechanisation in agriculture

A critical step in modernising agriculture is the adoption of mechanisation to replace human labour. Most of Africa is still far behind this stage. In sub-Saharan Africa, agricultural mechanisation has either stagnated or retrogressed in recent years. Over 60% of farm power is still provided by human muscle, mostly from women, the elderly and children. Only 25% of farm power is provided by animals, while less than 20% of mechanisation services are provided by engine power.

As observed in most parts of the world, the adoption of animal force, tools and equipment enhances the production and productivity of different crops due to timeliness, precision and improved quality of operations.

At first sight, one may conclude that the replacement of human labour in the agriculture fields by machines would result in increased unemployment. However, this displacement can be compensated by the growing demand for human labour due to multiple cropping, greater intensity of cultivation and higher yields. Furthermore, the demand for non-farm labour for manufacturing, servicing, distribution, repair and maintenance, as well as other complementary jobs, are substantially increased due to mechanization.

Farm mechanization greatly helps the farming community in developing overall economic growth. These conclusions were observed in a study conducted in the Punjab Agricultural University in India, but similar results were reached in other developing countries such as Bangladesh. This model will certainly bear fruits when replicated in Africa as a whole.

A study conducted by the International Journal of Agriculture Innovations and Research (IJAIR) in Nigeria, showed that mechanization significantly increased the productivity of cassava fields and that farmers who adopt mechanization, have an increased income in comparison to those who only use human labour.

To be successful and sustainable, policies for agricultural mechanisation development must be tailored to local needs and must be firmly embedded in broader agricultural policy approaches. To ensure an effective transition from hard-labour jobs in the fields towards jobs related to the increased use of mechanisation, governments have to set the right policies and incentives.

Setting the right policies

The legacy of the agricultural policy environment is evident in global and domestic markets. Africa’s farmers have a limited presence in global markets. The region as a whole exports less than Thailand. West Africa now accounts for around one-fifth of world rice imports. Nigeria’s food import bill for rice currently exceeds $2bn a year. The reason: is that average annual rice production has stagnated at 28kg per capita since 1990, while per capita consumption has increased from 18kg to 34kg. Rice imports have been growing at 11% a year to fill the gap.

To try to counter this foreign dependence, the Nigerian government has introduced a number of key policies and investment strategies to increase domestic rice production and improve its competitiveness with imports. This is being done through a combination of import restrictions, input policy and institutional reforms, and direct investments along the rice value chain.

Its effectiveness is questionable though. Some of the measures are likely to be difficult to implement or will only have a short-term influence. This is the case of import restrictions, which may hurt consumers and farmers who grow crops other than rice. Since rice is a staple food in Nigeria, present in the daily meals of most of the population, raising its price is likely to cause inflation and affect GDP negatively.

Focusing more attention on technology change and market improvement seems more promising. A modest increase in rice yields, the expansion of high-quality varieties to replace low-quality ones, and improved processing technologies, can increase the competitiveness of domestic rice.

Singapore’s engagements in agricultural Africa

There are some big Singaporean-based companies engaged in ventures in the agricultural sector in Africa. Olam, for example, deals with the sourcing, processing and distribution of raw materials such as cocoa, sugar, beans, palm oil, and nuts, and is the world’s biggest supplier of cashews and sesame seeds. It began operating in Tanzania in 1994, with its head office in the capital Dar es Salaam and branches spread out in five other cities. There the company manages an integrated supply chain for four key products: cotton, sesame, cocoa, and green coffee.

In 1997, Olam expanded to Uganda, where it transacts the same products as in Tanzania, but also imports and distributes sugar and edible oil. The head office is located in the capital Kampala, and branches are spread through eight locations. Olam has a broad operation there, extending along the value chain from origination and processing to logistics and distribution. Africa plays an important role in the company’s portfolio: 27% of total sourcing volume comes from Africa, where 29% of sales turnover is generated.

Rice extension farming in Nigeria and outgrow programmes in cashew processing in Tanzania and Mozambique, exemplify Olam’s approach to linking farmers to its supply chain. In these countries, the company supports farmers through extension services, providing training, buying back produce and acquiring farm equipment.

Another example of the agricultural link between Singapore and Africa comes from Wilmar International, which in 2012 was the largest supplier of cooking oil to China and Vietnam. In 2010, the company founded a joint venture, PZ Wilmar, in Nigeria, to build a sustainable future for palm oil in that country. Palm oil is used in cooking oil, confectioneries and baked goods. Since the subsidiary was founded, it was responsible for creating up to 30,000 direct and indirect jobs; this helped reduce Nigeria’s current domestic palm oil production shortfall and import deficit.

Wilmar revitalised unproductive, previously-owned palm oil plantations and invested in new ones, helping to close the 350,000-tonne palm oil import gap. In this process, the company built a state-of-the-art palm oil refinery and packaging facility in Lagos.

Wilmar also ensures that skills are transferred via on-the-job training, to secure optimal harvests with minimal wastage. In addition, the company also owns oil palm plantations in Ghana, and through joint ventures, owns plantations in Uganda and West Africa. As of the end of 2014, Wilmar had more than 14,000 hectares of planted area in Africa.

The potential

Africa has the land, water and people needed to be an efficient agricultural producer – and to feed an expanding urban population. The Guinea Savannah, a vast area that spreads across 25 countries, has the potential to turn several African nations into global players in bulk commodity production. In addition, countries such as Ghana, Mali, Senegal, Mozambique and Tanzania, have large breadbasket areas that could feed regional populations, displace imports and generate exports.

This potential is yet far from being fully explored, but some milestones have been reached. According to the UN Food and Agriculture Organisation, Rwanda’s farmers produced 792,000 tonnes of grain in 2014 – more than three times as much as in 2000. Production of maize, a vital crop in east Africa, jumped sevenfold. Cereal production tripled in Ethiopia between 2000 and 2014. The value of crops grown in Cameroon, Ghana and Zambia has risen by at least 50% in the past decade.

The single most pressing challenge facing Africa’s governments is to harness the continent’s increasing wealth and use it to improve people’s lives. Agriculture is at the heart of that challenge. To reduce poverty and boost economic growth, Africa will have to develop a vibrant and prosperous agricultural sector.

Singapore is aware of Africa’s vast potential to become the world’s granary and is making the right moves to tap into this opportunity. By investing and transferring technology and skills to the local population, it ensures that best practices in agriculture can be easily adopted by future generations. The improvements achieved by Olam and Wilmar International in the continent are real examples that this is the right strategy to implement. That is how agriculture in Africa will reach the standards of productivity and quality necessary to feed its own population and also to become a net exporter of agricultural products in the near future.