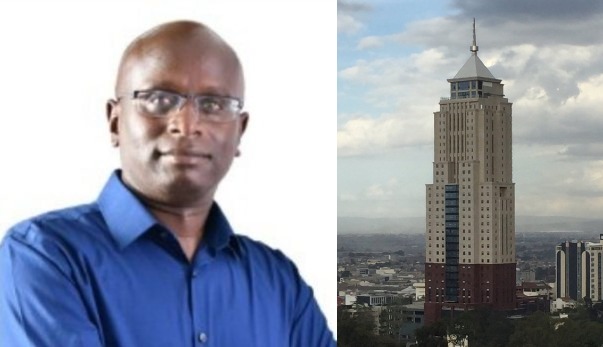

The UAP Old Mutual Tower in Nairobi is one of the tallest buildings in Kenya. The building became the tallest in Nairobi when it opened in July 2016 after more than five years of construction.

Stories about UAP Old Mutual Tower can’t be told without mentioning Julius Talaam the architect who designed the building, whose construction was inspired by the Empire State Building in downtown New York.

Talaam is a senior architect at Triad Architects, a Nairobi-based firm, and a principal at Laam Architects. He studied architecture at the University of Nairobi and was also a consultant for Telkom from 2008 to 2009.

He has contributed in the construction of other Nairobi landmarks among them the Global Trade Center (GTC) building in Westlands, Nairobi.

Located on Hospital Road, in Upper Hill Nairobi, the UAP Old Mutual Towers is a 33-storey building that offers some 300,000 square feet of Grade A office space.

According to web sources, the building became the tallest structure in Kenya upon its completion in 2015, surpassing Times Tower, which had held that record for 15 years.

Notably, the building occupies an impressive 2.15-acre space and has an observation deck that offers a 360-degree view of Nairobi from its observation deck.

Little known owners of Nairobi’s Imenti House with Sh. 8 million rent collection

UAP Old Mutual Tower is owned by UAP Old Mutual Group, a financial services conglomerate headquartered in Kenya, with subsidiaries in six African countries.

The construction of the tower was financed through private equity at a total of approximately USD 40 million. As of December 2022, Old Mutual valued the building at Sh5.5 billion.

Old Mutual Tower Put on Sale

In October 2023, The Old Mutual Group Holdings announced the sale of the Old Mutual Tower, on the back of rising debt service costs.

The sale of the iconic tower was announced in a notice to shareholders on October 30, 2023.

“Finance costs on borrowing were up 96 percent over the same period in 2022 due to increased interest rates as well as forex losses on the portion of debt that is US dollar-dominated,” Old Mutual disclosed to its shareholders.