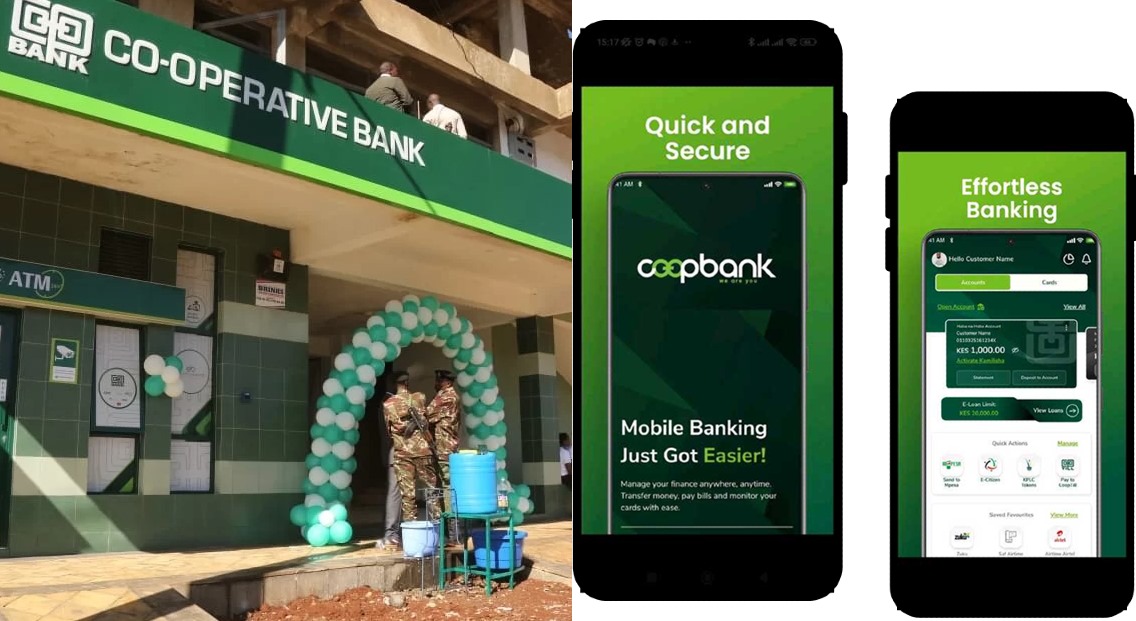

The Co-operative Bank of Kenya (Co-op Bank) has unveiled a revamped mobile banking App that now delivers faster, more secure, and user-friendly features as it seeks to deliver a seamless banking experience.

The new Co-op Bank Mobile Banking App is an upgrade from the previous Mco-op Cash App and provides an all-in-one bespoke digital banking outlook.

Key features include digital account opening, meaning customers can open an account at their convenience and begin banking instantly, anytime, anywhere. The app also features self-unlocking using selfies, assuring users that their money and personal data are safe.

Customers using the app can also transfer funds to other accounts, invest and access loans conveniently.

Some of the accounts customers can open on the new Co-op Bank app are:

Jumbo Junior

The Jumbo account is a transactional account designed for children below the age of 18 years for the safekeeping of money. The account offers various benefits, including exclusive banking offers and discounts.

Features

- No Monthly Maintenance Fee

- Minimum Operating Balance: Sh500

- Free Ele-bank on opening a new account

- Free Birthday Card every anniversary

- Interest rate 6% Per Annum

Requirements

- Parent’s or guardian’s original ID Card as well as a copy

- Copy of birth certificate of the child

- Minimum opening / operating balance of Sh500

- Debit card (optional) @Sh600

- Copy of KRA PIN

YEA Account

The Youth Account (Young Ennovators Account) is designed for students and young adults aged between 18 and 35 years. It enables them to access a variety of banking, money transfer and payment services.

A customer may register for the service by dialing *667# on mobile phone or download the app from the Play Store.

Features

- Digital account opening (KSH and USD)

- Access to Virtual Cards

- Free monthly e-statements

- Free internal standing orders

- Negotiated discounts at selected outlets nationwide

- Easy account management and online payments (e.g., Netflix, Spotify, eBay) via the YEA App

- Ability to view live FX rates on the YEA App

- Share transaction receipts digitally

- In-App Co-op till request

- Access to MSME loans for youth in business

- Access to E-Credit for salaried youth

Requirements

- Original ID Card as well as a copy

- Copy of KRA PIN

Co-op Bank named best in product innovation at Global SME Finance Awards

Salary Account

This is a transactional account designed to facilitate salary processing. It’s targeted at employees and is arguably the best salary account in Kenya

Features

- Minimum opening balance – Nil

- Minimum operating balance – Nil

- No Monthly Maintenance fee

- Salary processing fee applicable

- Access to Asset products such as Unsecured Personal Loan, Asset Finance, Mortgage and Cash Advance.

- Debit card

- Access to a credit card

Requirements

- Identity card/ Passport- original and copy

- Passport Photo (To be taken at the branch)

- Sh600 for the Debit Card (inclusive of Excise Duty of 20%)

- Copy of KRA PIN

- A letter of introduction from the employer is not required

Haba na Haba

This is a business account designed for small businesses to help them navigate operating challenges.

Features

- No minimum operating balance

- Access to funds as many times as required

- Account holder can access business loans

- Debit card available for withdrawals as well as for payments purposes at all VISA branded points

- Low monthly ledger fee

- Offers transactional solutions to account holders

- Convenient mobile banking and internet banking available

Requirements

- Copy of National ID Card

- Minimum opening balance of Sh550

- Copy of KRA PIN

HEKIMA

This is a savings account that allows users to save and earn interest on their savings.

Features

- Minimum opening balance – Nil

- Minimum operating balance – Nil

- Monthly maintenance fee – Free

- Interest calculated daily on credit balances and paid quarterly

- Permits only one withdrawal per calendar quarter

- Regular statements every 6 months

- No ATM or debit card

Requirements

- Original ID Card or Passport as well as a copy

- Copy of KRA PIN

The new Co-op Bank Mobile Banking App is available for download on both the Google Play Store and Apple App Store.

Did you love the story? You can also share YOUR story and get it published on Bizna Click here to get started.