The government of Kenya has awarded a controversial Chinese firm Sh. 40 billion tender. The tender is for the construction of the Kipevu Oil Terminal in Mombasa. Shockingly, emerging reports have pointed out that the firm which got the tender had been blacklisted by the World Bank even before bids for the project were opened. This has added to the list of controversial construction projects in Kenya.

According to a report that appeared in the Daily Nation on Monday, the controversial awarding of the tender to the Chinese firm have formed part of an investigation by the Ethics and Anti-Corruption Commission (EACC).

Shockingly, the report also says that the cost of the project was inflated from Sh. 15 billion to Sh. 25 billion, and then to Sh. 40 billion.

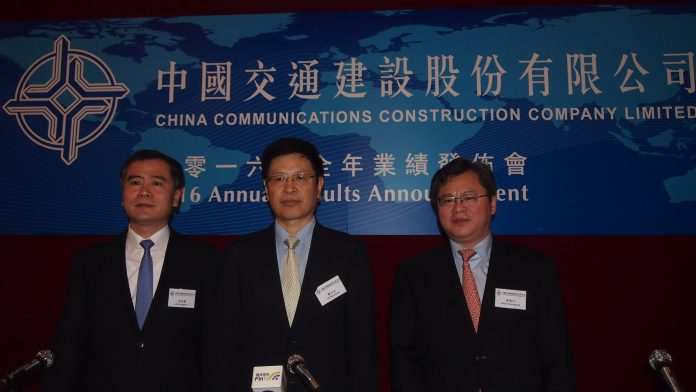

“Kenya Ports Authority (KPA) floated the tender on March 23, 2016 and 31 bidders from at least 15 countries showed interest. According to a press release issued by KPA during the prequalification stage, which was done in May 2016, tenders for construction were supposed to be issued in July 2016 and construction to commence at the beginning of 2017. But it wasn’t until June 30 last year that China Communications Construction Company (CCCC) was awarded the lucrative tender after close to two years of waiting. KPA delayed making the announcement until September for unknown reasons,” says the report in the Daily Nation. “CCCC’s parent company, China Road and Bridge Corporation (CRBC), had been blacklisted by the World Bank in 2009 for an eight-year period until January 12, 2017, after an investigation discovered that CRBC had engaged in collusive practices in World Bank-funded projects in the Philippines.”

The Nation report says that a whistle-blower notified the Public Procurement Regulatory Authority (PPRA) and EACC about the controversial cost and tender award in August 2018. But CCCC responded by saying that being blacklisted by the World Bank did not stop it from bidding for tenders. However, says the report, being blacklisted is the biggest sign that a company has been found to be corrupt.

The report in the Nation also says that the EACC is also investigating the inclusion of a Liquefied Petroleum Gas (LPG) component to the terminal, which is being seen as a plot to shoot up the cost of construction.

“Correspondence between KPA and oil marketers shows that there is a plan to construct two LPG lines. One line will be operated by the State while the second one will be handed to private operators. This means the State, which has plans to introduce a single gas tender — commonly referred to as the open tender system — and prompt a shift to control of gas prices, will be in direct competition with powerful gas players,” says the Nation report.