Ecobank Kenya, in partnership with Fingo Africa, a Kenyan Fintech company, has launched the Fingo Africa app, which is set to revolutionize financial inclusion for young people in Kenya and across Africa.

The launch of the App in Kenya comes barely three months after the Fintech company was granted regulatory clearance by the Central Bank of Kenya (CBK) to launch its offerings in the Kenyan market.

The app, which is set to be rolled out across Ecobank’s pan-African footprint, will enable users to open a bank account via their mobile phone in less than four minutes, as well as send money to other Fingo users for free.

Safaricom launches Fuliza for Business with limits of up to Sh. 400,000

Users will also be able to transact money to M-Pesa and paybills via Paybills and Till numbers at subsidised rates, as well as purchase airtime.

The app also promotes a saving culture, allowing users to Save money easily for set goals and set recurring transfers to the set goals to create a frictionless savings habit.

According to Fingo, African youth struggle to access financial services – taking anywhere from two days to two weeks in some countries, with multiple in-person interactions and requirements to bring physical paper documents.

In addition, consumers also face a steep fee when sending money to friends, loved ones, or businesses, besides other charges, just to keep their accounts active.

Launch of the Kenya Quick Response Code Standard to increase usage of Digital Payments

Fingo contends that its digital product will increase the number of young people accessing banking services by eliminating the need for paper-based processes, resulting in a more convenient experience.

“We are delighted that our Fingo Africa app will accelerate financial inclusion for Kenya’s youth and empower them just by using their mobile phones,’’

“We are looking forward to rolling out the app’s availability throughout Ecobank’s 33-country footprint, which will deliver on our vision of empowering Africa’s youth to create wealth in a way that is simple, fun, and educative.” Kiiru Muhoya, CEO and Co-Founder, Fingo Africa, stated

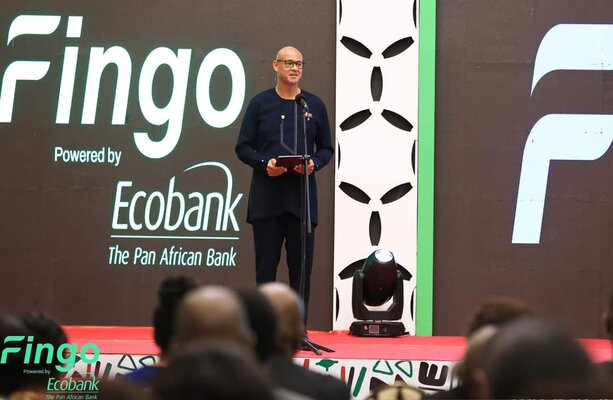

Speaking during the launch, Ecobank Group CEO Jeremy Awori said the app is a game-changer in digital finance in Africa, adding that the innovation is aligned with one of Ecobank’s core missions to drive financial inclusion across Africa.

“We are proud to support the deployment of the Fingo App, a game-changer in digital finance in Africa that brings many young people into the mainstream financial sector and caters to their needs and preferences,’’

Letshego Kenya launches “LETSGO CASH” in partnership with Creditinfo Kenya

“By simplifying access to finance, it overcomes the entrenched issues that have often acted as barriers to entry for young Africans. I want to thank our partner, Fingo, for driving such innovation that is aligned with one of our core missions to drive financial inclusion across the continent.” Said Awori.

The Fingo Africa app is currently available in Kenya, prior to a wider roll-out across Ecobank’s entire 33-country sub-Saharan African footprint.