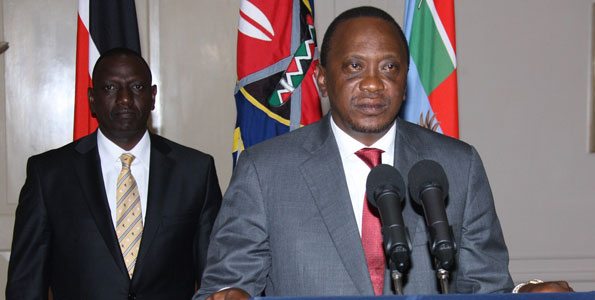

Economy Under Uhuru: Kenya is in the red. The economy is doing bad. Debts are piling up. There is no money in the pockets of Kenyans. And shockingly, President Uhuru Kenyatta – the man tasked with leading the country – has no clue why Kenyans are broke.

This has been revealed by a report that appeared in the People Daily, a newspaper that is in fact owned by the Kenyatta family.

Construction of Kenyatta family’s Sh. 500 billion city kicks off

Apparently, Uhuru is reported to have put his advisors to task to explain why Kenyans are broke. The paper on Tuesday quoted a senior government official who attended a meeting at State House to address the current crisis of low cash circulation in the economy.

The official said the President put them to task over the poor state of the economy as the head of state insisted that the economy ought to have been doing better as a result of the many infrastructure projects he has reportedly launched.

“ The President wondered where all the money being used to construct government projects is going. In fact, he specifically asked us the question: Why are people broke; why is it that there is no money in their pockets? ”the source said to be a parastatal boss stated.

Others who were present at the State house meeting included Cabinet Secretaries, among them acting National Treasury Cabinet Secretary Ukur Yatani, Fred Matiang’i (Interior), James Macharia (Transport and Infrastructure), Peter Munya (Trade), and Attorney General Kihara Kariuki.

Among the resolutions passed was an order for parastatal heads to immediately release Sh34 billion in pending bills owed to suppliers.

It is hoped that the new money will help revitalize the economy and create more cash flows in the country.

President Kenyatta also banned government-owned institutions from investing in Treasury bill where at least Sh100 billion of public funds are said to be putting cash at the expense of suppliers.

Treasury Bills (T-Bill) are a form of short-term investment where an investor gives a short term loan to the government, usually with a maturity date of less than a year.

Economists and a section of politicians have called on government-owned corporations to be banned from trading in Treasury bills which essentially allows the National Treasury to take loans and pay interests to public entities at the expense of the private sector. Economy Under Uhuru. – Additional reporting by Pulse.