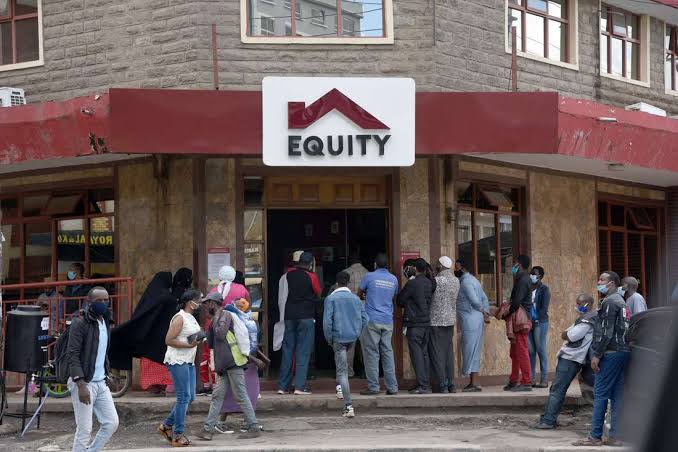

Equity Group has reportedly fired about 2,000 employees following an audit that uncovered irregularities in employee accounts and customer transactions.

According to media reports, the Equity Group ethics and conduct audit flagged suspicious inflows into employee salary accounts and mobile wallets.

Staff were required to explain deposits that exceeded their earnings; those unable to justify the funds were subject to disciplinary hearings and exited with only basic dues.

Despite the staff exits, the bank’s wage bill rose after an average 20 percent pay increase was implemented and backdated by two months.

Staff costs grew 19.2 percent in the nine months to September, reaching Sh28.5 billion. The lender raised salaries for its permanent staff, capping entry-level salaries at about Sh116,000, up from Sh65,000.

The pay rise is part the lender’s new compensation structure that adjusts compensation in line with business performance.

The latest crackdown adds to other similar fraud cases involving employees, including senior managers across various branches. In May, Equity sacked over 100 employees over a theft that saw the lender lose Sh1.5 billion in 2024.

The theft, allegedly orchestrated by an insider in collaboration with external players, raised serious questions about internal integrity and spurred a wider audit of staff conduct.

Equity Group CEO James Mwangi said the investigation dug deep into whether staff were compromised in their dealings with customers and service providers.

The bank focused on transactions involving suppliers, procurement, insurance claims, and loan processing.

“We were shocked that we could see money changing hands between… we didn’t know whether it’s appreciation, whether it’s a kickback,” he added. “We said, but you have signed this code of conduct. It says you can’t.”

Mwangi said some employees had been receiving unexplained deposits either in their salary accounts or on their registered M-Pesa numbers from entities linked to the bank, including customers and colleagues. Those who failed to justify the transactions were dismissed and given 14 days to appeal.

ALSO READ: Credit Bank turns to shareholders for capital boost under new CBK thresholds