Taxes are by far the biggest absorber of wealth in Kenya for businesses and individuals. They should be a tool for progress, but in Kenya, they are aggravating the prevailing slow-down of the economy. These are the words of Phylis Wakiaga, the immediate former chief executive officer of Kenya Association of Manufacturers. These words carry the weight of local businesses that are struggling for air as the government strangles them out with aggressive taxes.

The taxes are so punitive that if you are seeking to start a business or invest in Kenya, you should first brace yourself for a very rough ride.

The government will do all it can to bring you down; the cost of doing business, the endless taxes and levies will make sure that your business does not survive and your investment does not return.

Every other day, it seems that the government is seeking ways to bring down local businesses under the guise of creating additional revenue streams for the Kenya Revenue Authority.

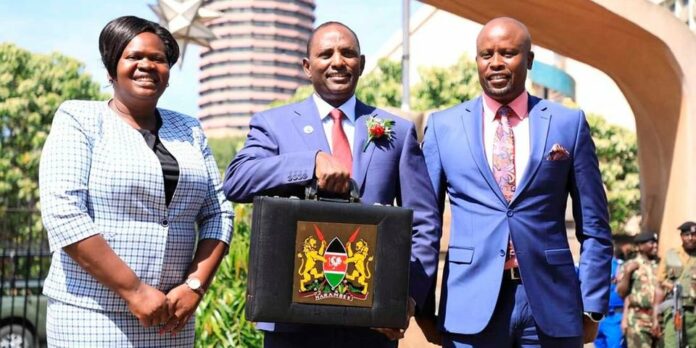

Currently, Kenyans are staring down at some of the most aggressive taxes to ever get introduced into the economy. These taxes are contained in the Finance Bill 2022. They are amendments to the Excise Duty Act.

If passed, a series of products including motorcycles, glasses, spirits, cosmetics, soda, water, beer, alcohol advertising, and capital gains will suffer from a high installation of taxes ranging by over 10 per cent to over 25 per cent.

For instance, these taxes, if implemented, will mean that within just one year, the government through the National Treasury will have increased excise tax on beer by 45 per cent and on spirits by 55 per cent.

Bottles will take by 25 per cent tax hit while alcohol advertising will take a 15 per cent excise duty hit.

The ripple effects of these taxes will be felt by the end consumer. “Goods that are expensive to produce, will be expensive on the retail end. The customer will be forced to pay more, and eventually, they will decrease the quantities they purchase,” says Wakiaga. “This will make it harder for producers to move these goods off the shelf and businesses will suffer.”

For many consumers, the alternative is likely to be illicit, cheap brews and spirits.

This is not the first time that the government has attempted to introduce punitive taxes with disastrous results.

On January 1, 2015, the government had attempted to introduce capital gains tax following a 30-year-long suspension on taxing gains made from the transfer of property and securities.

The capital gains tax (CGT) would be enforced not only on the gains made on the sale of land and securities, but also on gifts and insurance settlements. “In the event that you lose a property or it is destroyed and you are paid a settlement, which is a gain on the original value of the property then you will need to pay 5 per cent capital gains,” the KRA had said.

When CGT was reintroduced in 2015, the Nairobi Securities Exchange immediately shed 4.2 per cent in value with $8.8 million (about Sh. 1.02 billion) foreign net outflows. “This tax had been abolished in 1985 to encourage investment on shares and property,” says economic analyst David Musyimi.

Kenya’s debt repayment to China more than doubles to Sh. 73 billion

In the new Finance Bill 2022, this tax will now be raised from 5 per cent to 15 per cent. Musyimi explains that when you sell an asset that has gained value, you will pay an increase tax by 10 per cent if this Bill goes through.

“This hike is a slap on the face and a statement that the government is no longer interested in nurturing a friendly environment to do business or even invest at a personal level,” says Musyimi. He adds that these taxes are a series of a bad taxation regime that has been exacerbating the already high cost of doing business in the country.

Ironically, the Treasury is aiming to execute this Bill at a time when the economy is struggling to attract investments. Take the local bourse which is recording historic lows. On Friday May 20, the NSE 20 Share Index fell below the psychological mark of 1,700 points to close at lows of 1,680.53 points.

But it is not just property, shares, and the alcohol sector that are set to be hit hard. Duty on motorcycles will also be affected. Duty on a motorcycle unit will rise from Sh. 12,185.16 per unit to Sh. 13, 403.64 per unit. Cosmetics and beauty products such as wigs will also be hit.

“You cannot keep increasing taxes when everybody else is crying and saying life is hard. We need to adjust our pockets… the Government should also minimize how much it is taking from us,” says Kenya Association of Manufacturers Chairman Muchai Kunyiha.

Shockingly, the Finance Bill 2022 has also proposed to hike the price of Unga with a 16 per cent Value-Added Tax on maize, wheat and cassava flours. According to Musyimi, the taxation measures in this Bill will push the country into hyperinflation and increase the cost of living.

“Most of the products earmarked for higher taxes will affect the Consumer Price Index (CPI) due to the impending increase in consumer prices,” he says.

Manufacturing will also be stifled because the higher taxes will raise cost of production. This will in turn favour imports as opposed to local manufacturing. “With glasses, for example, manufacturers of bottles and glasses from Comesa countries will have a competitive advantage over local manufacturers,” he says.

Already, Kenya has been gaining bad reputation for being unfriendly to businesses. According to a Stanbic Bank East Africa Purchasing Managers’ Index (PMI) report on Manufacturing, a lot of manufacturers have been opting to leave Kenya for better alternatives offered by other countries in the region. This is majorly due to the exorbitant taxes the government has been introducing every so often.

Breakdown of the Finance Bill 2022 tax hikes:

- 16 per cent Value-Added Tax on maize, wheat and cassava flours.

- 10 per cent Excise duty on motorcycles

- 10 per cent Excise duty on beer

- 20 per cent Excise duty on spirits

- 15 per cent Excise duty on cosmetic and beauty products

- 15 per cent duty on advertising fees for adverts on alcohol and gambling

- 25 per cent duty on glass