KCB Group PLC and Riverbank Solutions Limited have signed a binding agreement that will see KCB acquire up to 75 per cent shareholding in the financial technology firm, to strengthen KCB Group’s distribution network across the region.

The successful completion of the transaction is subject to conditions that are customary for transactions of this nature including receipt of regulatory approvals from, amongst others, the Central Bank of Kenya.

The deal will boost the Group’s digital capabilities, by bringing on board Riverbank’s footprint in banking agency, social payments and business solutions. Riverbank has a presence in Kenya, Uganda and Rwanda.

How KCB Group roared from Sh37.5bn to Sh61.8bn net profit in one year

The acquisition will see KCB tap into Riverbank’s capabilities in payment ecosystems and non-banking offerings including capability building, networks and marketplace solutions.

Through Riverbank’s technology platform, ‘Zed 360’, KCB will provide its SME and MSME- customers with business management tools such as inventory management, financial reporting and payroll management which will ease their financial operations, enhance visibility and empower informed decision-making for both the customer and the Bank. Riverbank also offers three other solutions namely Swipe platform for agency banking services, Zizi for revenue collection and CheckSmart for social payments.

Once the transaction is completed, Riverbank will become a subsidiary of KCB Group Plc.

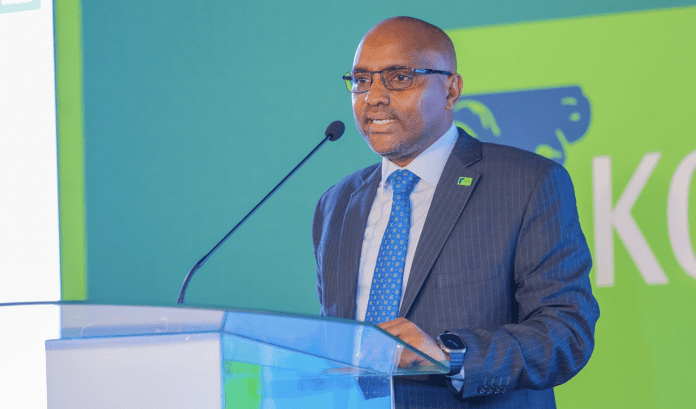

“We are actualizing new digital capabilities to deliver customer-centred value propositions through technology to guarantee seamless, reliable, secure, and innovative solutions for our customers. Across the region, payments are expected to have the fastest growth, suggesting an opportunity to innovate. That’s why we have made this strategic acquisition to enable us offer a full stack of solutions. This is a great opportunity to maximize value for our shareholders in the long-term while strengthening the competitive position for the Group,” said KCB Group CEO Paul Russo.

“Riverbank is not new to us as they have been providing us with Agency Banking Solution since 2013. Additionally, we see true value in the Zed 360 platform under which we expect to step up the delivery of our value proposition to MSMEs as well as in harnessing the ecosystem banking.,” he added.

The acquisition is part of an ongoing strategy by KCB to increase innovation of digital MSME offerings, focusing on seamless transaction and payment services, instant digitized lending, provision of business management tools and offering non-banking solutions such as business training and marketplace presence for our customers. The transaction will help the Group accelerate its strategy to interconnect with partner platforms and fintechs to offer services such as virtual wallets and payment APIs.

This will see KCB consolidate its agent banking channels into one platform. According to the latest financials released earlier this month, KCB Group Plc’s profit after tax for the full year 2024 grew by 64.9% to KShs. 61.8 billion, accelerated by strong topline expansion across all businesses. This was a rise from KShs. 37.5 billion reported a similar period last year. The Group’s balance sheet closed the year at KShs.1.96 trillion, funded by a strong deposit franchise and stable loan portfolio, despite the tough operating environment.

On the technology front, we continued to create a simple, more agile, and digitally led bank, achieving significant milestones such as establishing a Digital Centre of Excellence, upgrading core banking systems at BPR and NBK, and innovative product rollouts like digital term loans for MSMEs and the Worship 360 App for faith-based organizations. These advancements enable us to serve our customers better while enhancing operational efficiency.