A young Kenyan has narrated how he was tricked into working as a scammer in the United Arab Emirates (UAE) by a recruitment agent.

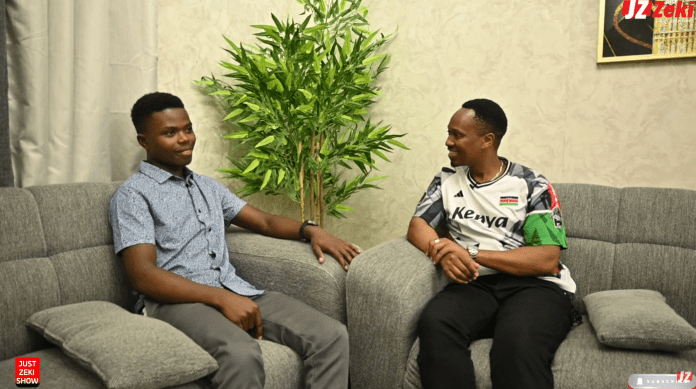

Sharing his story on the Just Zeki YouTube channel, the young man, identified as Mark Onyango, said he was recruited for what was advertised as a “Data Entry” job.

Onyango explained that he secured the job in 2024, shortly after completing his studies at Nairobi-based KIPS Technical College, where he studied electrical engineering.

“My father funded the entire process. He told me he spent about Sh300,000 to secure my passport and visa. He really wanted me to get out of this environment, go abroad, and try to find something meaningful for myself. I am the second-born; my elder brother, the first-born, is also outside the country but within Africa,” Onyango recounted.

Upon arrival, Onyango landed in Sharjah, where a chauffeur picked him up and took him to his new workplace in Ajman, about 14 km away.

My employer hasn’t collected my bank details 3 weeks since I joined, what should I do?

“When I left Kenya, I hadn’t signed any legal job contract, but I was promised a job in the UAE, so I went. I was on a visit visa. I arrived in Sharjah at around 11pm, and by midnight, I was already in Ajman taking my first job test. I was exhausted,” he continued.

Unexpected job test

The 23-year-old explained that, to his surprise, the only requirement for the job was a typing test, where he had to type at least 25 words per minute.

The test was conducted on an online platform.

“I failed on my first and second attempts, but luckily, a Kenyan there spoke on my behalf. I asked for some time to calm down, and after relaxing, I aced it on my third attempt,” he recalled.

After passing the test, Onyango was assigned a trainer—a woman who revealed the shocking truth about the job.

“So, the lady asked me, ‘Mark, do you know what kind of work you’re getting into here?’ I told her I had been recruited for a data entry job. She giggled and told me they were scammers. I thought she was joking until she showed me the scripts they were using. That’s when I believed her.

“I was in shock. When leaving Kenya, I had even bought a crisp suit, but upon arriving, I found people in casual wear, miniskirts, and slippers. It was a shocker, but I had no choice but to take up the job,” Onyango explained.

Nature of the scam job

Onyango confessed that the job was conducted at night, targeting victims in continents like South America.

The scam cartel, he said, was well-organized, using tactics like social engineering to manipulate victims.

“We would call our victims and introduce ourselves as representatives of famous artists with music on Spotify. We claimed we were looking for people to earn money by simply listening to and liking select music on the app.

“All they had to do was send evidence in the form of a screenshot, and we would pay them about KSh 200. This would happen two to three times before we moved them to the next stage,” Onyango explained.

In the next phase, the victims—who had now gained trust in the scammers—were introduced to an “investment opportunity” that promised to triple their money.

Dos and don’ts: How to answer ‘What is your salary expectation’ question

“The first time, we asked them to send money, and once they did, we doubled the amount and sent it back to them. By this point, they fully trusted us.

“Then we asked them to invest larger amounts, and once they did, we vanished. They never heard from us again. We had defrauded them, and on our side, we had made profits,” he revealed.

According to Onyango, the scam operation employed Kenyans, Nigerians, and Chinese nationals.

“The pay was good. It was handsome. I had no complaints,” he admitted.

However, despite the lucrative returns, workers were not allowed to go outside and spent all their time indoors.

Police raid and escape

After working for a few weeks, Onyango said their hideout was raided by police, leading to a chaotic escape.

“The raid happened at around 3am at one of our sister branches, and they alerted us. So, we had to take off.

“Imagine being in a foreign country, where you don’t know anyone, and suddenly, you’re on the run. We were told to flee or risk arrest. I had never interacted with the outside world in the UAE. We ran and spent the night outside, fearing arrest,” he recalled.

After the escape, Onyango managed to find a bed space through a friend and started searching for a legitimate job.

“The money I earned from the scam operation felt jinxed. I lost about KSh 17,000 to someone who promised to help me find a job. Later, KSh 40,000 was stolen from me. After several weeks, I managed to get the proper legal documents to stay in the UAE and found a job to sustain myself,” he said, adding that at one point, he even traveled to Iran in search of stability.

Warning to job seekers

Onyango urged Kenyans seeking jobs in the UAE to be cautious about the contracts they sign and to conduct due diligence before traveling.

In his parting shot, he said:

“Despite all these challenges, it’s good for young people to experience different environments. Don’t just stay in the same space for years. You will only grow and develop if you step out of your comfort zone.”

Red flags in employment contracts

Bizna Kenya talked to a HR expert James Ogweno who shared about redflags in job contracts that jobseekers need to watch out for.

They include:

Unclear salary and benefits details – A contract should explicitly state the salary amount, payment date, and mode of payment.

Vague probation clauses – Some employers misuse probationary periods to avoid obligations.

Undefined job descriptions – A poorly defined role can lead to an employee being overworked or assigned duties beyond their scope.

Ambiguous termination clauses – Contracts should clearly state notice periods and grounds for dismissal to protect employees from unfair termination.

Delays in issuing a contract – A company withholding or delaying contracts is often a red flag, as Section 9 of the Employment Act requires written agreements before work begins.

Non-compliance with statutory deductions – Employees should ensure their employer is remitting NSSF, NHIF, and PAYE contributions as required by law

“Employees should never shy away from seeking clarity on their salaries. At the end of the day, payment is a legal obligation, not a favor,” Ogweno concluded.