Kenya is known as one of the most enterprising countries in Africa.

Over the years, the country has produced numerous successful business tycoons, who have built large empires from humble beginnings.

Unfortunately, some of these business empires have collapsed due to various reasons such as lack of succession planning, internal fraud, fierce competition, and boardroom wrangles, among others.

This article highlights some of the most prominent Kenyan business tycoons whose empires collapsed.

Jared Kangwana: Kanu-era tycoon who founded KTN, multi-billion business empire

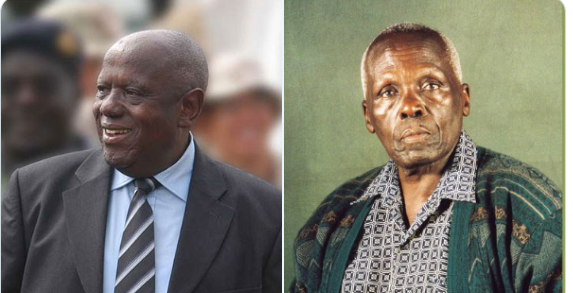

Njenga Karume

Njenga Karume was a former cabinet minister and a successful entrepreneur who built a business empire from a small business selling stationery that he started in elementary school.

He went on to build 25 businesses, which included ventures in real estate and hospitality, as well as stakes in 46 other companies. Karume’s estate was estimated to be worth Sh 40 billion, and he instructed his children to triple the size of his estate within five years of his death.

Unfortunately, his estate has decreased in size and value due to ongoing court battles for its control seven years after his death in 2012.

Despite the formation of the Njenga Karume Trust, the lack of succession planning in 24% of the businesses has led to collapses after the deaths of their founders.

Meet the little-known tycoon behind the popular Afia juice

Karume’s estate has been the subject of multiple court battles between trustees and family members, which has slowed decision-making, caused losses, defaults on loans, and resulted in tax arrears.

Joram Kamau

Joram Kamau was the founder of Tuskys, one of the largest supermarket chains in the Great Lakes Area. At its peak, the supermarket chain employed over 6,000 people in Kenya and 150 in Uganda.

However, the business collapsed two decades after Kamau’s death due to various reasons such as sibling rivalry, internal fraud, aggressive debt-fuelled expansion, and fierce competition.

By August 2020, the business had accumulated debt worth Sh 6.2 billion owed to suppliers and creditors.

Despite entering a Sh 2 billion agreement with a Mauritius firm to ward off financial constraints, the closure of its last branch in Nakuru proved to be the last nail on its coffin.

Atul Shah

Atul Shah was the founder of Nakumatt, one of the most profitable supermarket chains in Kenya with gross annual revenue in excess of Sh 48.5 billion.

The business had 65 stores in the African Great Lakes countries of Kenya, Uganda, Rwanda, and Tanzania with over 5,500 employees.

However, Nakumatt began experiencing serious cash-flow issues in 2016. It was unable to meet its financial obligations to landlords, suppliers, and staff. An administrator was appointed to help it regain financial footing.

However, in December 2019, the retail chain sold the last six branches to Naivas Supermarkets in a deal that saw its brand disappear. In June 2018, a damning audit report revealed Sh 18 billion disappeared under ex-boss Atul Shah’s watch.

Meet the little-known owners of Khetia’s supermarket who built it from scratch

The creditors in the case included DTB, which was reportedly owed Sh 3.6 billion, Kenya Commercial Bank (KCB) owed Sh 1.7 billion, and StanChart Sh 805 million.

The retailer also owed Bank of Africa Sh 328.4 million, United Bank of Africa Sh 126.2 million, and GT Bank Sh 104.8 million.

Creditors formally voted to liquidate the company on January 7, 2020.

Sherali Hassanali

Sherali Hassanali Nathoo’s Akamba Bus Company was once a thriving business with a network spanning over 50 destinations.

Nathoo founded the company from humble beginnings in Machakos county and successfully built it from scratch to become the dominant player in the transport industry.

However, after Nathoo’s passing in September 2000, his sons Moez and Karim took over the company but failed to replicate their father’s success.

Boardroom wrangles, family disputes, escalating fuel prices, and recession led to the company’s collapse in 2012. The company’s financial health was on its knees, and wrangles began at the board level, leading to physical brawls.

The company could not pay employees, and almost half of the fleet was grounded due to scarcity of spares.

In December 2010, it was clear that the company was going under, with bookings low and passengers often stranded due to frequent bus breakdowns.

The company’s problems escalated to fuel shortages, defaults on payments to suppliers, and terminated contracts with oil firms, leading to auctioneers selling off company properties in 2011.

Spencon

Spencon was a prominent construction company with a long-standing legacy in East Africa. Founded by Jitendra Patel in 1979, the company had operations in multiple countries including Kenya, Tanzania, Uganda, India, Zambia, Malawi, Mozambique, and Southern Sudan.

At its peak, Spencon boasted a massive workforce of 5,000 employees, a testament to its widespread success.

However, the company’s fortunes began to decline after Emerging Capital Partners (ECP) invested Sh 1.5 billion in 2009 and acquired a 37.4% stake.

Despite efforts to save the company, including the appointment of Andrew Ross to lead a turnaround effort, Spencon eventually succumbed to financial difficulties and collapsed in 2016.

The demise of Spencon resulted in the loss of hundreds of jobs and was a blow to the construction industry in East Africa.