Kenyatta Shares on NSE: The NSE has been on a bull run, thanks to the rallying price rise of banking shares.

Revelations have now emerged that the Kenyatta family, the family of former Central Bank of Kenya governor Philip Ndegwa and Equity Group chief executive officer James Mwangi have each gained more than Sh.1 billion over the past two weeks.

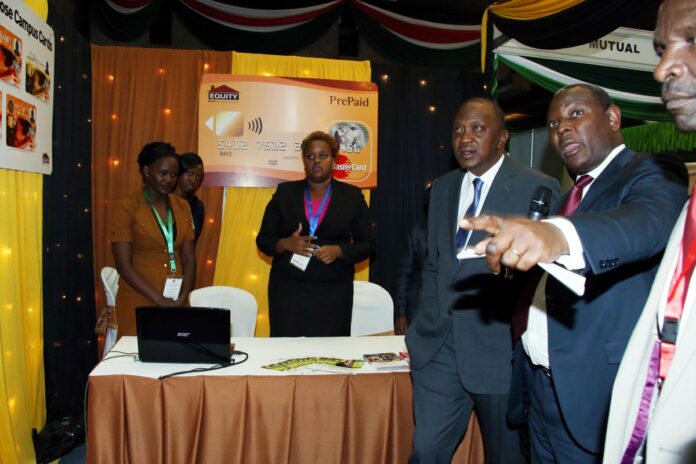

According to a report that appeared in the Business Daily on Friday, Equity CEO’s five percent stake in Equity Bank has gained Sh.1.6 billion since October 18. That was the day that President Uhuru Kenyatta asked that lawmakers remove the cap on lending rates. Mwangi’s stake in Equity Bank is worth Sh. 8.7 billion.

Kenyatta family now own Sh. 6.6 billion stake in NCBA bank

“He was followed by the Kenyatta family, whose 13.2 percent stake in NCBA Group has increased by Sh. 1.08 billion since their shares were listed at the Nairobi bourse on October 22, pushing their wealth in the bank to Sh. 7.7 billion. NCBA emerged following the merger between the listed NIC Bank and the private CBA Group, and the merged shares including those owned by the Kenyatta family started trading on the bourse last Tuesday. The Ndegwa family, which owns 12 percent of the merged bank, have seen their paper wealth in the lender increase Sh. 1 billion to hit Sh. 6.8 billion,” says the report.

By Friday, says the report, Equity had risen 23.6 percent over the two weeks to close trading at Sh. 46.50 yesterday, while Barclays Kenya jumped 19.3 percent to trade at Sh. 13.30. “KCB Group gained 21.5 percent, NCBA (16.3 percent) and Co-operative Bank surged 16.9 percent, which saw the 1.7 percent stake held by its CEO, Gideon Muriuki, rise Sh. 209 million pushing his worth in the lender to Sh. 1.4 billion,” says BD on the Kenyatta shares on NSE.