The Co-operative Bank has launched an innovative online payment solution for small businesses in Kenya.

This new solution comes as the rise of online marketplaces heralds a new mode of shopping where many customers are now preferring to have goods delivered to them at home and have the option of paying via card.

“We are cognizant of the rise of online merchants who conduct their payment via social media channels like Facebook, Instagram, Twitter, and online market places like jiji.co.ke,” said Co-op Bank in a statement to Bizna Kenya. “Some of these merchants might be missing out from customers who prefer to pay via card due to lack of physical locations where the customer can visit and pay via a POS terminal.”

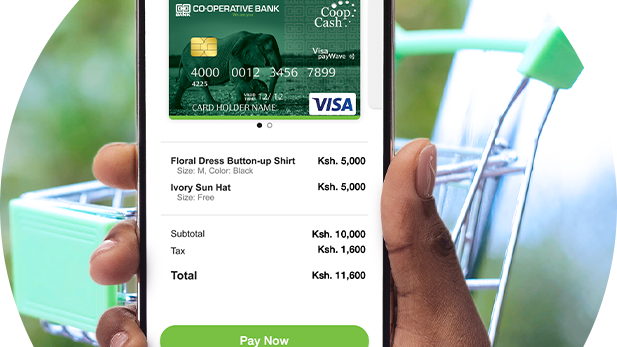

To provide solution to these challenges, Co-op Bank has enhanced it’s E-commerce solution, making it possible for business owners to receive payment via card without necessarily investing on a website or an app.

Under this online payment solution, the merchant will send the payment link to the customer’s email address once they agree on the pricing. The customer will open the link and open up a portal where they will insert their card details and the amount they are to pay. Once the payment goes through, the merchant will receive a payment confirmation via email and SMS. The customer will also receive a notification via SMS in the event they has subscribed to SMS alert with their card provider.

“The merchant will not incur any cost to get the Pay-By-Link solution. It is FREE to get on-boarded. We have made the solution 3D secure with two factor authentication for all card payments,” says Co-op Bank.

Co-op Bank launches Kenya’s first pension-backed mortgage

In the event a customer makes the wrong payment, the merchant can reverse the payment without calling the bank for a reversal. However, the customer will not be able to reverse a payment, which will reduce the risk of merchants losing money to scammers. “Payment reconciliation is easy for the merchant since they can track payment and view payment from a single dashboard,” the bank said.

The new online payment solution cements the bank’s lead position as the most digitized lender in the Kenyan market.

Co-op Bank moves to streamline the boda boda sector

Already, the bank has been running digital banking solutions that have come in handy amidst the ongoing pandemic and the measures that have been instituted to curb the spread. These solutions have included:

- E-commerce solution– This enables businesses receive card payment through their websites or app

- POS solution- Merchants don’t need to handle cash. Customers can pay for their goods and services via card at a Co-op Bank POS terminal.

- M-Pesa Paybill 400200 – Customers can pay directly into the merchants Co-op Bank account via M-Pesa paybill number 400200

- M-Pesa paybill 400222- With this Pay bill, reconciling of payments done via M-Pesa into your Co-op Bank account is easy! The statements include the customer name, student number or house number and their phone number making payment reconciliation easy. This solution is ideal for school, landlords/landladies, or merchants that receive bulk payments.