Richest Kenyan businessmen: In 2017, Java House was sold for quite a significant amount.

It’s founder and Chairman Kevin Ashley made billions of shillings after the popular coffee house was acquired by a Dubai-based private equity firm Abraaj Group.

In 2017 private equity company Abraaj Group acquired 100% of Java House and its affiliated brands from American Emerging Capital Partners, with a focus on growing the coffee chain’s footprint into Africa.

American founder and chairman, Kevin Ashley – who later sold a majority stake in the company to Emerging Capital Partners (ECP), established Java House, the largest casual dining food services chain in East Africa with 60 outlets, in Nairobi in 1999.

ECP helped Java House grow from 13 shops in Nairobi into East Africa’s largest casual dining brand, building an ‘eat-out’ culture. By 2017, Java had a regional footprint of 60 stores across 10 cities in Kenya, Uganda and Rwanda.

The brand has grown beyond the mainstream capital cities of the three countries, opening new outlets in second tier towns including Nanyuki, Nakuru, Mombasa and Kisumu in Kenya; and in Jinja town in Uganda – beyond any other competing coffee house brand.

Kevin Ashley pocketed a cool Sh. 1.3 billion from the sale of his 10 per cent stake. In 2012, Kevin sold his 90 percent stake to Africa-focused ECP for an undisclosed amount although he had previously said Java’s annual revenues had crossed the Sh. 4 billion mark. Sources familiar with the transaction said Abraaj group acquired East Africa’s largest coffee chain at an estimated price of Sh. 13 billion.

See why Kenya abandoned this KQ plane in Ethiopia

Here are Kenyan companies which were also acquired at billions of shillings.

#1. Interconsumer Products by L’Oreal

The world’s leading cosmetic company acquired the health and beauty division of Interconsumer Products one of Kenya’s largest manufacturers of personal care and beauty products in 2013 for at the very least, Sh. 3 billion ($35.3 million).

Kenyan businessman Paul Kinuthia, who founded the company in 1995 with start-up capital of Ksh 3,000 ($40).

Why Kenya’s degree holders are among the poorest people in the country

#2. Suzie Beauty by the Flame Tree Group

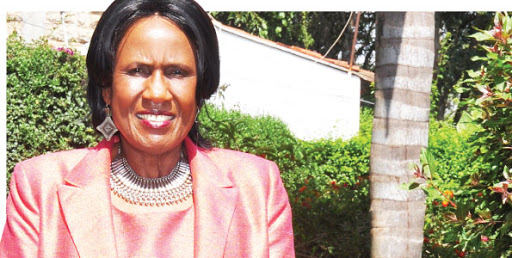

Suzie Wokabi, the Founder of SuzieBeauty Cosmetics, smiled all the way to the bank in 2016 after selling her seven-year-old SuzieBeauty Cosmetics company to a listed firm, known as Flame Tree Group.

Suzie Wokabi, the Founder of SuzieBeauty Cosmetics, smiled all the way to the bank in 2016 after selling her seven-year-old SuzieBeauty Cosmetics company to a listed firm, known as Flame Tree Group.

When asked about how much she made after selling her company worth billions of shillings she had this to say.

“I will give you only one answer. Yes, I made some good money, but can’t talk figures. I mean I did not make ‘nothing,” she said.

#3. Buzeki Dairies by Brookside Dairies

The maker of Molo Milk and Kilifi Gold was acquired by Brookside Dairies in 2013 for billions of shillings.

Sources familiar with the deal said Business man, Zedekiah Kiprotich Bundotich alias Buzeki the brainchild behind Buzeki dairies pocketed a whooping Sh1.1 billion from the deal.

Brookside Dairies is owned by the wealthy Kenyatta family.

#4. Giro Commercial Bank Ltd by I&M

Kenyan shareholders were a happy lot early this year after Giro Commercial Bank Ltd was acquired by Kenya’s I&M.

Kenyan shareholders were a happy lot early this year after Giro Commercial Bank Ltd was acquired by Kenya’s I&M.

As per the deal, I&M was to pay USD 250 million in cash and offer owners of Giro Bank a minority stake in a USD 250 million share sell deal.

IMF created 21,043,330 new shares valued at Sh. 121.05 each, to be used in the transaction.

#5. Makini Schools bought by Advtech

Dr. Mary Okello earned nearly Sh. 1 billion from the sale of a 71 per cent stake in her school Makini. The Makini Schools founder sold the high-end group of eight schools to two foreign investors. She surrendered the management of the institution that host over 3,200 students in April this year to UK-based investor Scholé Limited and South Africa’s Johannesburg Stock Exchange (JSE)-listed Advtech.

Earnings from the school that was started some 40 years ago are estimated to stand at around Sh. 800 million per year with the students paying annual fees of around 250,000. Makini School fees to rise after buyout deal “A 71 per cent interest in Makini School Limited (via Schole Mauritius Limited) was acquired on 1 May 2018 for a consideration of R130.8 million (about Sh. 930 million),” disclosed Advtech in a trading update. Richest Kenyan businessmen.

Richest Kenyan businessmen Source: Business Insider