All Kenyans both in the formal and the informal sectors, are set to contribute a certain percentage of their monthly income to fund the new social healthcare fund.

According to the fund’s regulations released by Health Cabinet Secretary Susan Nakhumicha, all salaried workers will remit 2.75 percent of their gross salary every month to cater to the fund.

“A household whose income is derived from salaried employment shall pay a monthly statutory deduction contribution to the Social Health Insurance Fund at a rate of 2.75 percent of the gross salary or wage of the household by the ninth day of each month,” reads the draft in part.

Here is the amount salaried workers will be deducted per month based on salary group.

Rich earners spared from high NHIF deductions; low earners to pay from gross salaries

Salary Monthly health insurance deduction

Ksh100,000 2,750

Ksh90,000 2,475

Ksh80,000 2,200

Ksh70,000 1,925

Ksh60,000 1,650

Ksh50,000 1,375

Ksh40,000 1,100

Ksh30,000 825

Ksh20,000 550

Ksh10,000 300

Kenyans in the informal sector will also have to part ways with 2.75 percent of their monthly income. The Ministry set Ksh300 as the minimum contribution one can make.

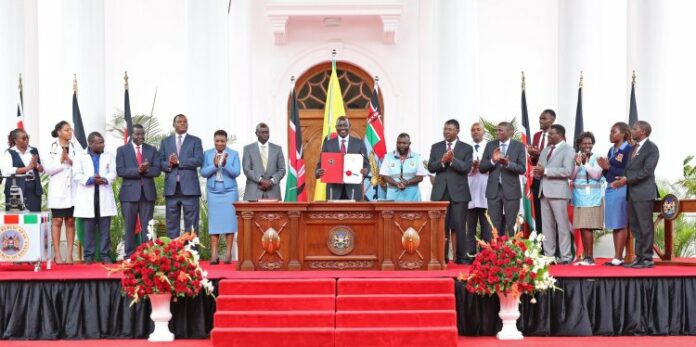

The new Social Health Insurance Fund is set to phase out the National Health Insurance Fund (NHIF), which has been operational for 57 years.

The draft regulations will undergo public participation before the proposed deductions are effected.

If passed, the Social Health Insurance Act 2023 will see NHIF disbanded and a Social Health Authority created in its place to manage three funds— primary healthcare fund, healthcare fund, and emergency, chronic, and critical illness fund.