Borrowers on Safaricom’s Fuliza overdraft can now clear their loans using their loyalty points, popularly known as Bonga Points.

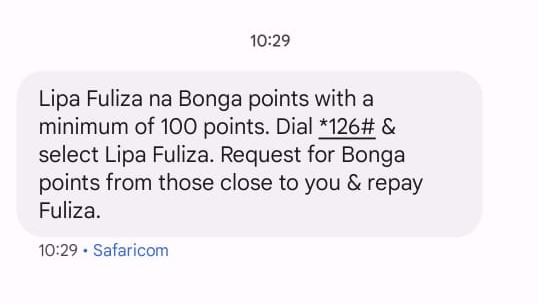

In a message to its customers, the telecommunication giant noted that this service is only available to customers with a minimum of 100 points.

It is however not clear the maximum loan amount borrowers need to have to be eligible for the service. To get started, Safaricom notified customers with uncleared loans to dial *126# and select the ”Lipa Fuliza’’ option on number 8.

”Lipa Fuliza na Bonga points with a minimum of 100 points. Dial *126# and Select Lipa Fuliza. Request for Bonga points from those close to you and repay Fuliza’’ reads the message.

Fuliza M-Pesa, an overdraft facility for all M-Pesa users, allows customers to complete M-Pesa transactions even with insufficient funds in their accounts.

KCB overtakes Equity with Sh. 16.5bn net profit, Sh. 1.99 trillion assets in Q1

Customers can fuliza as many times as they want as long as they are within the allocated limit.

Safaricom automatically deducts the full amount borrowed from a customer’s account immediately after money is deposited, a move that has helped the telco curb defaults.

Since its launch in 2019, Fuliza M-pesa has become one of the most dependable services as Kenyans seek short-term loans to pay day-to-day bills.

Safaricom’s latest financial results show that Fuliza disbursed Kshs. 833.8bn in 2023, an 18.9% rise from 2022, further cementing its position as the biggest credit provider in the MPESA ecosystem.

The data, which shows the telco’s performance for the full year ending March 31, 2024, indicates that at least Sh2.3 billion was borrowed on the Fuliza overdraft every day.

Safaricom attributed this to the affordability nature of Fuliza as a fit-for-purpose solution to the market.

The telco’s move to introduce the Lipa Fuliza na Bonga points option provides customers with an extra repayment option, easing their debt burden.

In addition, the move is likely to help clear the pile of unredeemed Bonga points, which hit a high of Sh4.5 billion in value in the financial year ending March 2022, up from Sh4.2 billion in the previous financial year.

The loyalty scheme allows subscribers to earn one Bonga point for every 10 shillings spent on voice calls, short message service (SMS), data, and M-Pesa services.

Bonga Points can be redeemed for rewards ranging from Talk-time (Minutes), Data bundles, MMS, and SMS bundles.

PrePay subscribers have the option to redeem for either SMS, data bundles, or minutes while PostPay subscribers only use the points for SMS or minutes.

Safaricom recently made it possible for customers to use Bonga points to pay for various products and services, including water and electricity, among others, through an automatic conversion.