Small Business Owners Among Top Mobile Loan Borrowers

Small Business Owners and individual borrowers are moving more towards alternative lending platforms as tighter credit rules lock them out of conventional borrowing.

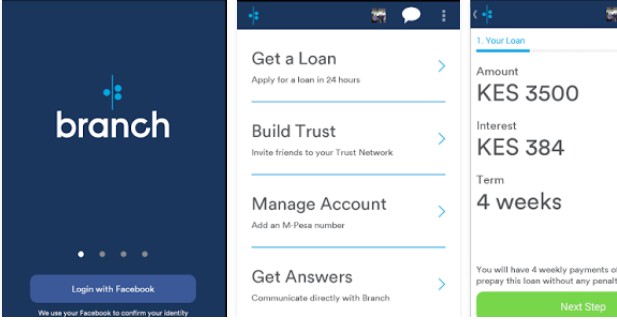

Lending startups, Branch and Tala said at least 70 per cent of borrowers using their platforms are small and micro business owners. The two have been operating in the Kenyan market since 2016 alongside Alternative Circle and Saida.

“The loans people need are more than just emergency loans, they need loans to finance their working capital,” Branch director for Africa Daniel Szlapak told the Star. “We hope to see these small businesses become bigger.”

The lending platforms which use highly predictive behavioural analysis technologies to analyse data from a user’s phone reach out to borrowers who may not necessarily be able to come up with collateral required in conventional banking.

Besides this, loan disbursement, done through mobile phones is instant allowing users to bypass formalities in the commercial banking systems.

Banking Sector Lending Regulations

Tighter credit regulations in the banking sector have resulted in lower credit growth especially when it comes to households and small business owners.

This means that accessing loans for personal and business use has become more difficult for the common mwananchi as lenders now perceive them as high risk.

“The customers we reach out to did not necessarily have access to conventional banking products originally,” Tala regional manager Rose Muturi told the Star.

This is in the wake of the now functional IFRS 9 accounting standards topping of on the already existing interest rate cap regime which have seen the banking sector shun small businesses and households on account of their high risk profiles.

“Unfortunately, it might be the small businesses that will be affected the most because of the high risk aspect,” Kenya Bankers Association chief executive Habil Olaka told the Star late last year. “Coupling IFRS 9 with the impact the interest rate cap has had, I think the two will probably curtail growth in specific segments.”

Despite being profiled as high risk by commercial banks, most borrowers on the online lending platforms pay back on time so they can build up their loan portfolio and access more funds.

Credit Scoring

With daily loan applications in the tens of thousands, Branch and Tala have been able to maintain a loan repayment rate of 95 and 92 per cent respectively.

The firms said it is based on their predictive credit scoring models that have enabled them lend to good payers.

Contrary to this, Central Bank of Kenya data shows gross non-performing loans grew 45.35 per cent in 2016 to Sh208.18 billion signaling a significantly high default rate.

Branch has so far disbursed $100 million with plans to diversify the brand into growing their maximum loan size currently at Sh50,000 and offering other financial services including savings, investment among others.

Interest Capping

Although the two firms said the interest rate cap did not have material impact on business, Szlapak said the emergence of strong fintechs will certainly eat into the market share of the main financial institutions.

“Very few financial institutions have been able to properly integrate technology. In the next 10-15 years we will see fintech firms take significant market share from the banks,” he said.

In 2017, Tala registered a 500 per cent increase in daily applications translating to about $225 million disbursed in Kenya which generates 90 per cent of the firm’s business.

“What we can say is the rate caps saw many small-scale borrowers being locked out of conventional borrowing,” Muturi said. “It however enabled alternative lenders to have space to speak with the potential borrowers.”