The season of merry-making has unfurled its vibrant wings, sprinkling joy and festivities; all facilitated by increased financial transactions. Yet, beneath the twinkling lights and jingling bells lurks an ominous shadow – Fraudsters. Cybercriminals often exploit the season’s hustle and bustle to target unsuspecting individuals. Take Mary’s experience for example. During a meeting, she received an alarming email claiming that someone had tried to log into her online banking account. The email urged her to click on a link to “secure” her account.

Although worried about potential unauthorized access to her account, Mary remembered her bank’s frequent security alerts and refused to click on the suspicious link. Instead, she reported the incident by calling the official customer service number listed on her bank’s website.

The bank confirmed it was a fraud attempt. Thanks to her vigilance, Mary avoided financial loss and strengthened her account security.

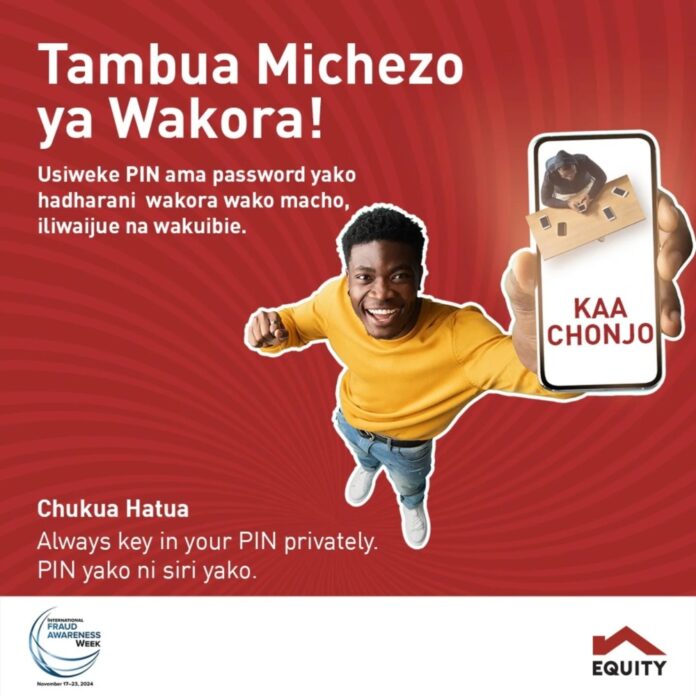

Fraudsters are constantly devising new ways to steal your hard-earned money. Here’s how you can stay safe:

- Set up unique passwords that are hard to guess.

- Enable alerts and notifications to track account activity.

- Activate two-factor authentication (2FA) for added security.

What is Two-Factor Authentication (2FA)?

Think of this as a second lock on your door. Even if someone obtains your password, they can’t access your account without the second verification step—such as a one-time code sent to your phone.

Think of this as a second lock on your door. Even if someone obtains your password, they can’t access your account without the second verification step—such as a one-time code sent to your phone.

For Equity Bank customers, the bank has dedicated itself to protecting your account. If you use the Equity Mobile App, Equitel lines, or *247#, remember these important tips:

- Do NOT engage fraudsters on calls or SMS—Equity will only call you from 0763 000 000.

- Do NOT share your PIN, Password, or OTP with anyone, including family or friends.

- Do NOT key in instructions you are given on your phone KATA SIMU/Disconnect your phone.

- Do NOT give your phone or laptop to strangers, even if they claim to represent telcos or other service providers or even to confirm purchases or sales.

- Do NOT share personal details like your account number, CVV, ID number, or date of birth.

- Do NOT share your bank statement online or on social media.

- Do NOT use public Wi-Fi for online or mobile banking.

- Do NOT click on suspicious links sent via email or SMS.

- Do NOT leave your phone with your children as they might be called by Fraudsters and asked to key in certain information on your phone and you find yourself losing your funds.

- Report any suspicious numbers or SMS lines to 333 for FREE.

Remember: Stay Alert, Stay Secure. Secure your transactions today! Protect yourself and your loved ones from fraud this festive season. To learn more visit: Secure Banking Tips | Equity Bank Kenya

#KataaUtapeli #KaaChonjo