As Russia’s invasion into Ukraine enters day five of the crisis, it has been a short turn of events without clear sight of how long it will take or how it will end. Experts are warning that the impact of the conflict is bound to reverberate across the African continent.

People in Africa have rushed to not only make the topic trend but also picked sides in this conflict. Before you take sides between Russia and Ukraine please note that this is not just a European war. Yes, the biggest impacts will be felt in Europe but the adverse effects will not stop in Europe.

Although some African countries may benefit from a shift in global markets away from Russia due to the crisis, the short-term potential impacts on economic livelihoods are worrying while the implications for pan-African solidarity and adherence to multilateralism are increasingly uncertain.

A small business owner somewhere in Africa may ask oneself ” This war is in Ukraine tens of thousands of Kilometers away, how does it concern me to care?”

Here are the top 5 things to note on how this conflict will affect your business

1. Fuel Prices

Russia’s attack on Ukraine and retaliatory sanctions from the West may not augur another global recession. The two countries together account for less than 2% of the world’s gross domestic product. And many regional economies remain in solid shape, having rebounded swiftly from the pandemic recession.

Russia is the world’s third-biggest producer of petroleum and is a major exporter of natural gas. With heavy Sanctions imposed on Russia, logistics of oil and fuel products from Russia will not only be complicated but also expensive. This will make the Middle-East and Gulf Nations close to a monopoly on the major global energy sources. This will make fuel prices skyrocket until Russia’s sanctions are lifted. For your business, stocking of more products will be more costly as the manufacturing costs of every product will rise.

Economists have warned that the war in Ukraine could further push oil prices up and increase inflation in Africa. “The last time we had a windfall from oil prices related to war was in 1991, during the Gulf War,” said Abdul-Ganiyu Garba, a professor of the Department of Economics at Ahmadu Bello University Zaria.

“We know it will directly impact the price of crude oil. The revenue may increase, but since we have shifted oil investment to multinational companies, they are more likely to reap greater revenues than the country itself.”

2. Gas Prices

Russia holds the World’s biggest gas reserves both explored and unexplored. Russia produces 22,728,734 million cubic feet (MMcf) of natural gas per year (as of 2015) Gas products are a fundamental energy source in the manufacturing sectors on the continent and in the past decades have become a popular cooking energy choice in Kenya and much of Africa.

The war in Ukraine will make the Russian government to reduce gas production capacity as a means to put the European Union and the USA under pressure to lift the sanction imposed on Russia. With gas prices over the roof, even meals for your employees and stocking products in your business will skyrocket. Sea logistics methods will become more expensive making all imports expensive.

3. Access to bank Loans

Russia has the has $600 bn in Gold reserves. Locking the Russian Central Bank out of the Swift system and international interbank messaging platform will make the market price of Gold rise to extra ordinary heights and thus pushing the global inflation to extra ordinary heights. With global inflation through the roof, banks will be hesitant to lend out of their money. Access to credit for SMEs who are seen as high-risk clients will become harder than it was before the war.

4. Food prices

Both Russia and Ukraine are not only key Agro products exporters but also major global fertilizer manufacturers. War in this region will not only make agro-exports from both Russia and Ukraine expensive but will also make local agro production costs higher due to the scarcity in the agro-fertilizer costings making local food production more expensive.

Despite these possibilities, in the near term, the invasion of Ukraine could pose hardships for African households, the agricultural sector, and food security. The rising price of oil on global markets—induced by the crisis in Europe will have direct impacts on the cost of transport. In fact, South Africa’s automobile association predicts that March will bring record-high fuel prices to that country. In Zambia, which agreed to cut fuel subsidies in order to adhere to post-pandemic debt negotiations with the International Monetary Fund (IMF), rising costs will make such reforms even more unpopular than they already were. Much to the disappointment of the IMF, last month, Nigeria already backed away from its plans to cut fuel subsidies after planned protests from labor unions and opposition parties.

Wheat and other grains are back at the heart of geopolitics following Russia’s invasion of Ukraine. Both countries play a major role in the global agricultural market.

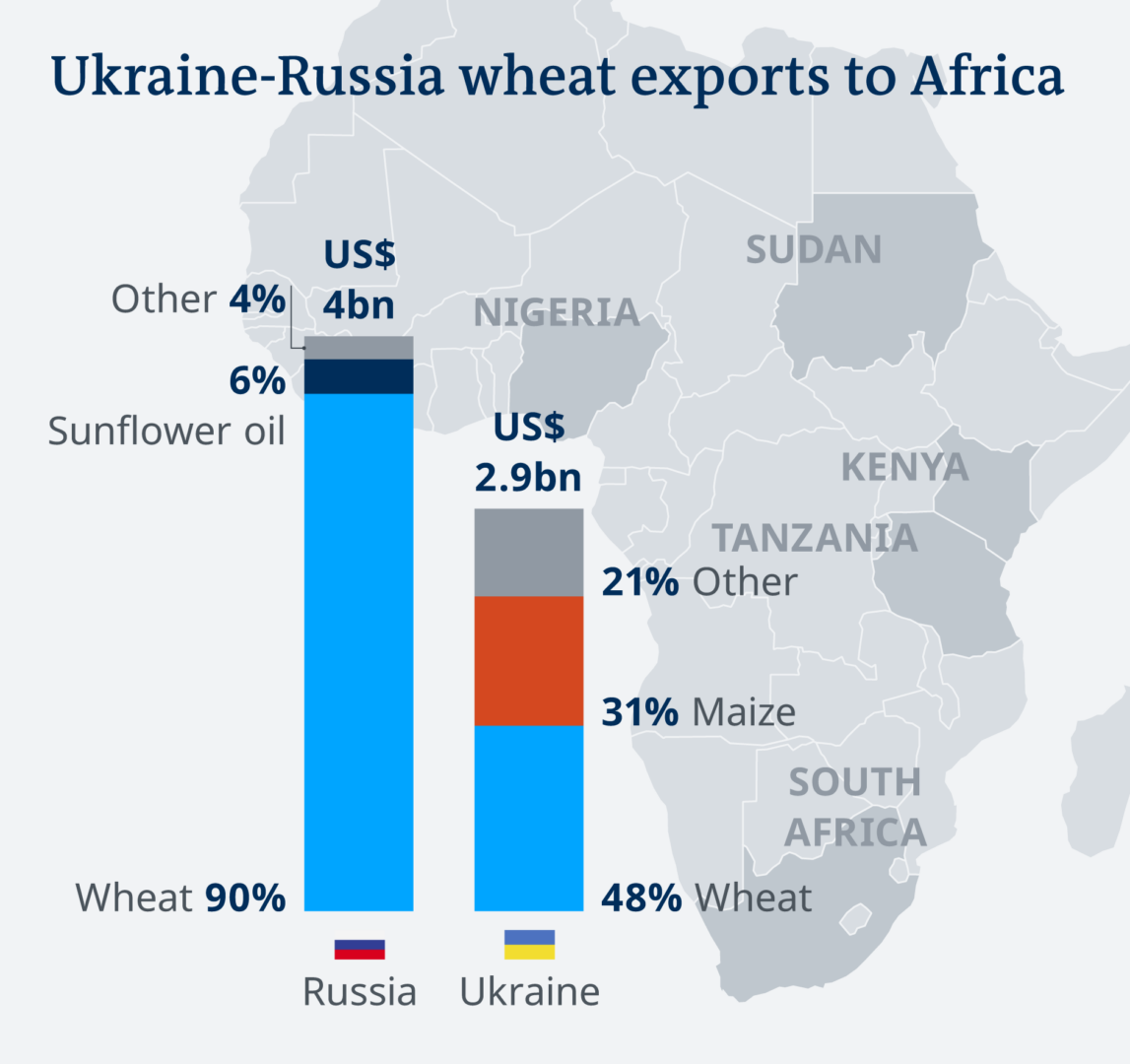

There is significant agricultural trade between countries on the continent and Russia and Ukraine. African countries imported agricultural products worth $4 billion from Russia in 2020. About 90 percent of this was wheat, and six percent was sunflower oil.

Major importing countries were Egypt, which accounted for nearly half of the imports, followed by Sudan, Nigeria, Tanzania, Algeria, Kenya, and South Africa.

Similarly, Ukraine exported $2.9 billion worth of agricultural products to the African continent in 2020. About 48 percent of this was wheat, 31 percent maize, and the rest included sunflower oil, barley, and soybeans.

5. Expect High Taxes

With the global economy taking a hit due to COVID-19, the Russian invasion will make it worse. Countries are looking for means to grow domestic revenues and improve the GDP ratio to local budget financing. With the crisis at hand, more countries will increase taxes to help them secure more gold reserves as means to brace themselves for tougher years post the war. As an SME your costs of operation will become more costly as long as the crisis deepens and this will not only cut your profit ratios but also could kick you out of business.

What to do in summary:

- Embrace cost-cutting methods for your business

- Collect your money from your debtors as soon as possible

- Organize for LPO financing with your bank. Protect your liquidity.

- Minimize or stop credit offers to your clients.

- Assess your industry risks and come up with aversive measures.

Lastly, pray for quick dialogue between the two countries and peace prevails.

By Frank Kiwanuka.