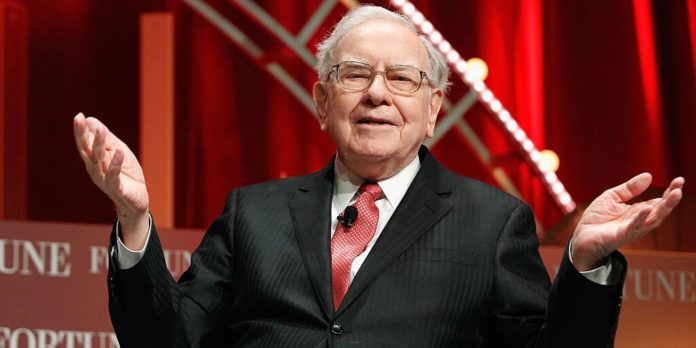

Warren Buffett Berkshire Hathaway: Business Insider: Warren Buffett’s Berkshire Hathaway can afford to buy almost any of America’s public companies after coronavirus fears decimated their market capitalizations in recent weeks.

The famed investor’s conglomerate boasted $125 billion in cash, cash equivalents, and short-term investments in US Treasuries at the end of December. Assuming that figure hasn’t changed, and looking purely at market caps — ignoring whether a purchase would be feasible, sensible, or even legal — Berkshire could buy one of more than 450 companies in the S&P 500, more than 80 in the Nasdaq 100, and 11 in the Dow 30 without needing a loan, as of the close of trading on March 27.

There are three ways to go broke: ‘liquor, ladies and leverage’ – Warren Buffett

For example, Berkshire could afford McDonald’s ($125 billion) or PayPal ($118 billion) in the S&P 500. On the Dow, it could snap up Boeing ($102 billion), IBM ($100 billion), or Goldman Sachs ($57 billion) without blowing its budget. In the Nasdaq 100, neither Tesla ($97 billion) nor Starbucks ($82 billion) would break the bank.

True, Buffett prizes financial security and has vowed to never exhaust Berkshire’s cash pile.

“We consider a portion of that stash to be untouchable, having pledged to always hold at least $20 billion in cash equivalents to guard against external calamities,” he said in his 2018 letter to shareholders.

Moreover, shareholders of a company on the auction block typically demand a premium to its current market cap to reflect its future earnings potential.

Assuming Berkshire wouldn’t spend more than $105 billion in total, and had to pay a 20% premium, it could still afford the industrials titan 3M ($78 billion), T-Mobile US ($73 billion), United Parcel Service ($86 billion), or General Electric ($71 billion). It could even buy Target ($48 billion) and have enough cash left over to buy General Motors ($32 billion).

As a cautious investor, Buffett would undoubtedly snub many of these businesses. However, the raft of possible acquisitions in his price range highlights both the scale of the recent sell-off and the rich potential of Berkshire’s huge cash pile.

Buffett is on the hunt for an “elephant-sized acquisition,” and his choice of elephants has grown substantially. Warren Buffett Berkshire Hathaway.