2020 Coop Half Year Results: The Co-operative Bank has reported a profit after tax of Sh. 7.2 billion for the first half of 2020. This came as the bank’s net interest income grew by 12 percent to Sh. 15.9 billion from Sh. 14.3 billion that was posted in the first half year of the 2019 financial year.

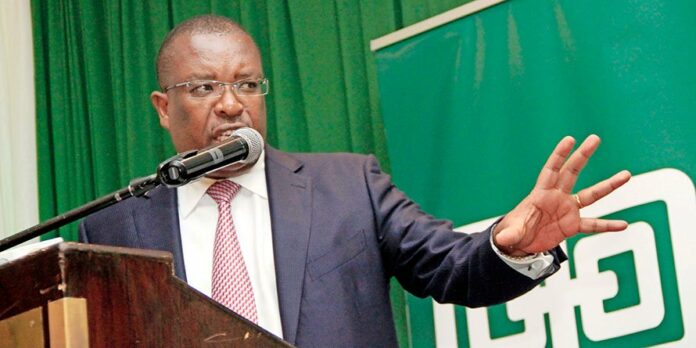

During the period, Co-op Bank restructured loans worth Sh. 39.2 billion as it moved to help its customers manage the economic impact of the coronavirus. “The group continues to implement proactive enterprise risk management initiatives to ensure uninterrupted business operations,” Dr. Gideon Muriuki, the Co-op Bank chief executive officer said.

Your chance to win Sh. 5 million in Co-op Bank innovation challenge

During the period, non-interest income decreased by 5 per cent to Sh. 8.3 billion. At the same time, total operating expenses grew by 16 per cent from Sh. 12.6 billion to Sh. 14.6 billion, driven largely by a high loan loss provision.

Customer deposits grew by 19 per cent from Sh. 323.6 billion to Sh. 384.6 billion. At the end of June, the lender was at Sh. 513.9 billion compared to Sh. 429.6 billion over a similar period last year. This saw the bank’s total assets during the period expand by a fifth, largely driven by investments in government securities as lenders parked their money in Treasury Bills and Bonds.

At the same time, Co-op Bank’s South Sudan branch posted a profit before tax of Sh. 102.6 million from the Sh. 93 million profit before tax it posted same period the previous year. Other subsidiaries such as Co-op Consultancy and Insurance Agency, and Co-op Trust Investment Services posted Sh. 387.8 million and Sh. 47.1 million profit before tax respectively.

“This strong performance is an affirmation of the resilience of the business in view of the most challenging operating environment occasioned by the Covid-19 pandemic that has brought about unprecedented economic and social disruption globally,” Dr. Muriuki said.