The government is set to borrow over Sh. 800 billion after its bid to raise debt ceiling to Sh. 10 trillion was approved by Members of Parliament.

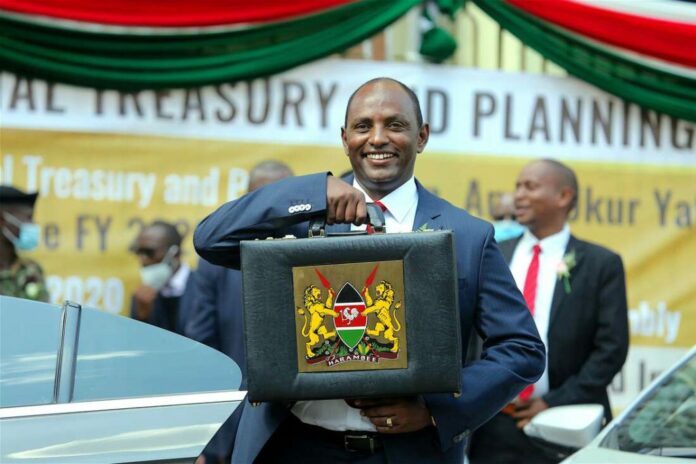

The MPs raised the debt ceiling following a push by the National Treasury Cabinet Secretary Ukur Yatani who is seeking to borrow more money to fund the budget deficit for the fiscal year starting July 2022.

The debt ceiling was raised from the current ceiling of Sh. 9 trillion. Official data from the Central Bank of Kenya (CBK) shows that the country’s public debt stood at Sh. 8.4 trillion by end of March.

This means that prior to the MPs raise of the debt ceiling, Kenya was just Sh. 600 billion shy off the mark. Parliament had raised the debt ceiling to Sh. 9 trillion from Sh. 6 trillion previously in October 2019.

The raise was done through a special Motion, amended the Public Finance Management (PFM) (National Government) Regulations of 2015, published as a legal notice number 89 of 2022.

Initially, Yatani had proposed to shift the debt ceiling to an anchor of 55 per cent of the Gross Domestic Product (GDP) in net present value terms.

This raise was opposed by Kimani Ichung’wa who is the former Budget and Appropriations Committee chairperson. He argued that the increase in debt cap arguing it will burden ordinary Kenyans. “As much as we are utilizing other people’s money, we will use taxpayers’ money to repay. I object to the rise. We are spending out of the budget and that is what is ballooning our public debt,” he said.

The next administration after the August 2022 General Elections is expected to implement the Sh. 3.33 trillion budget for the financial year 2022-23, with the country expected to borrow close to Sh. 846 billion.

Punitive Finance Bill 2022 will kill businesses, destroy livelihoods

The raise in debt cap came amidst efforts by the Treasury to raise a host of punitive taxes that would have hit manufacturers and investors hard. The Treasury had proposed to raise taxes on beer, wine and spirits, capital gains, sim cards, and cosmetics and beauty products.

Ich’ungwah had proposal is seeking to raise excise duty on beer, wine and spirits by between 20.2 per cent and 25.6 per cent. He had also proposed a new Sh. 50 excise duty on every imported ready-to-use SIM card.

If these proposals had been adopted, tax on a litre of beer will rise by 23.1 per cent to Sh. 150 from the current Sh. 121. This would in turn see the price of a bottle of beer rise by up to Sh. 15.

On its part, the National Treasury had proposed to raise excise duty on beer to Sh. 134 per litre, Sh. 229 for wine and Sh. 335.30 for spirits.

The proposals by the Treasury would have meant that within just one year, the government would have increased excise tax on beer by 45 per cent and on spirits by 55 per cent.