Mobile loan lending has revolutionized the financial landscape in Kenya, providing convenient access to quick loans for individuals in need.

Several mobile loan lending apps have emerged as popular choices among Kenyans, offering diverse loan options and flexible repayment terms.

Let’s explore the top five mobile loan lending apps in Kenya and their respective owners.

Inside Kizingo estate in Mombasa, where Kenya’s super billionaires Live

Zenka

Robert Masinde, a Kenyan businessman, has made a significant impact in the financial technology sector as the co-founder of Zenka Finance, a mobile loan lending app.

The company operates the Zenka mobile loan app, which has gained immense popularity among Kenyans due to its convenient and flexible loan services.

The name “Zenka” is fusion of two words, where “Zen” represents the concept of achieving balance, and “Kash” is an African adaptation of the word “cash.”

Established in December 2018 by Robert Masinde and his foreign associate, Lucas Notopolous, Zenka Finance aimed to offer personalized and adaptable loan services ranging from Sh500 to more Sh20,000.

This wide range ensures that borrowers have access to the funds they need for various purposes, whether it be for emergencies, business ventures, or personal endeavors.

The borrower is expected to repay the loan within 61 days and for a first-time borrower, you get to repay the loan with no commission.

With just less than five years in the country, the mobile app has grown to become one of the most trusted and highly preferred among Kenyans.

TALA

Tala, a prominent digital credit provider in Kenya, has emerged as a leading financial solution for individuals seeking quick and accessible loans.

With the ability to process loans of up to Sh 50,000 in just 10 minutes, Tala has revolutionized the lending industry with its efficient services.

The company boasts competitive interest rates, starting at a mere 0.3% per day, making it an attractive option for borrowers in need of financial assistance.

How to Acquire Mobile Loan Without App in 2022

The brainchild behind Tala is Shivani Siroya, an accomplished Indian-American businesswoman who transitioned into entrepreneurship after a successful career in investment banking.

Siroya founded Tala in 2011.

Under Siroya’s leadership, Tala has gained recognition for its commitment to leveraging technology to provide efficient and transparent lending solutions.

By embracing digital platforms and innovative algorithms, Tala has streamlined the loan application process, ensuring that borrowers can secure the funds they need swiftly and conveniently.

OKASH

Operating within Kenya, Okash has established itself as one of the prominent digital lending platforms in the country.

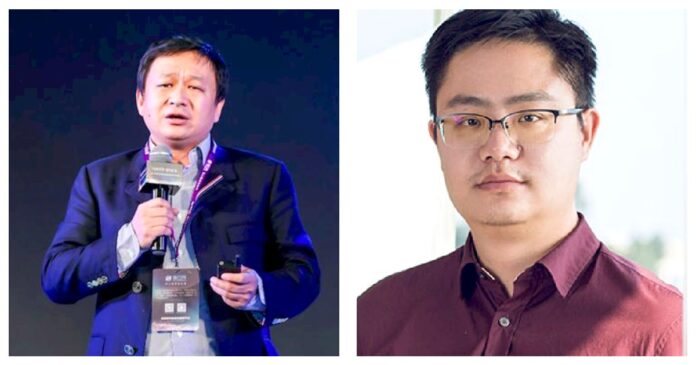

As reported by the Daily Nation, this mobile phone app falls under the umbrella of Opay Digital Services, a company owned by Chinese billionaire Yahui Zhou.

Opay Digital Services encompasses three Kenyan firms that provide loans through mobile phone apps, namely Okash, Opesa, and Credit Hela.

These firms have experienced significant growth since venturing into the lending business between 2018 and 2019.

Yahui Zhou, who acquired Opera Limited in 2016 in a remarkable Sh 133 billion deal, manages Opesa and Credit Hela, along with Okash.

Anthony Mutua: The Tech Guru behind the Shoe that Charges Mobile Phones

In December 2018, Opera further expanded its operations by acquiring Opay in a deal worth $9.5 million (Sh 1.3 billion), solidifying its presence in the digital lending sector.

During the fourth quarter of 2018, Okash demonstrated its financial prowess by generating $1.7 million (Sh 235.1 million) in revenue through over 280,000 microloans.

According to the Okash website, the loans offered by the platform are provided by Blue Ridge Microfinance Bank.

Branch

Branch Loan App, a short-term mobile loan lender, has made a huge impact in multiple countries, including Kenya, Nigeria, India, and Tanzania.

The app, developed by Branch International, provides users with convenient access to quick loans to meet their financial needs.

In 2015, Branch introduced its loan app to the Kenyan market, leveraging the widespread use of Safaricom M-Pesa to efficiently deliver loans to thousands of users.

This strategic partnership with M-Pesa, Kenya’s leading mobile money platform, allowed Branch to establish a strong presence and cater to the financial needs of a large user base.

Over time, Branch has experienced substantial growth and success.

With over 10 million installs on Google Play, the app has become a trusted and popular choice for individuals seeking mobile loans.

Branch has also formed significant partnerships with key industry players, including Visa, to enhance its loan offerings and provide even better services to its users.

Matt Flannery, is the founder and chief executive officer (CEO) of Branch.

3 types of mobile loans you can get on MCoop Cash

TIMIZA

Timiza Digital Loan, owned by Absa Bank Kenya, stands out in the digital lending market by offering accessibility to all individuals, regardless of their existing banking relationship.

Unlike other commercial banks that typically require applicants to hold a bank account, Timiza allows anyone to apply for a loan, even without prior affiliation with Absa Bank Kenya.

This inclusive approach sets Timiza apart from its competitors and positions it as a direct rival to digital lenders like Zenka, particularly for short-term loans of up to 30 days.

As a product of Absa Bank Kenya, Timiza benefits from the institution’s established infrastructure, regulatory compliance, and financial expertise.