The Central Bank of Kenya has finally approved Safaricom’s ambitious interest-free Lipa na M-Pesa loans.

The approval comes nearly a year after the CBK pulled the brakes on the launch of the product that was expected to disrupt the mobile loans market. Following this approval, Safaricom is now set to launch the product by the end of June.

The interest-free loans will now allow M-Pesa users to purchase goods and services on credit to a tune of up to Sh. 100,000.

In May this year, Safaricom chief executive officer Peter Ndegwa revealed that Safaricom had been addressing the concerns that had pushed the CBK to block the launching of the loans in 2022.

“I am sure it will show up. We needed to change a few things. We will bring it back. It needs to be approved normally just in the same way CBK approves (other products). It is a use case that customers want. You will see it come back,” Ndegwa had said.

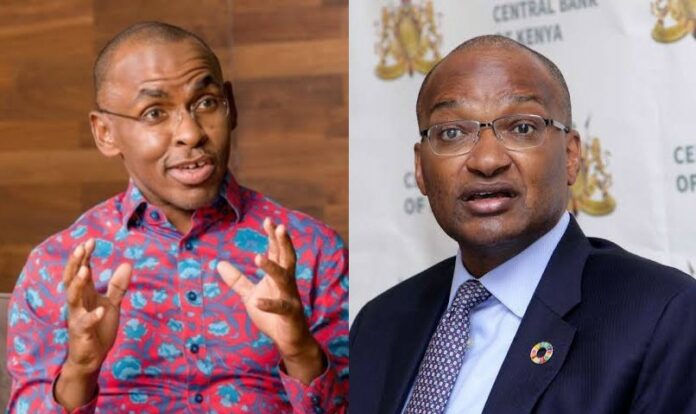

Kamau Thugge’s local dollar bond plan will kill Kenya Shilling, warns Njoroge

Dubbed Faraja, the loan service will be a collaboration between Safaricom, EDOMx Ltd, a Kenya-based financial technology firm, and Equity Bank. In July 2022, the Central Bank of Kenya blocked a plan by Safaricom to offer Kenyans M-Pesa zero interest loans.

CBK reportedly blocked the service dubbed as Faraja from launching on the day it was supposed to launch, and 8 hours to the start of the service.

The Central Bank reportedly claimed that service was still under regulatory review and that Safaricom needed to slam brakes on the launch.

The new loan product was expected to be one of a kind in the Kenyan market. It was supposed to work under Lipa na M-Pesa and would allow Kenyans to buy goods and services on credit without incurring interest fees.

Why CBK blocked M-Pesa zero interest loans from launching Using Faraja, customers would have been able to purchase products from Sh. 20 to Sh. 100,000.

They would then be required to pay back within a month at no extra charges, hidden fees or dafault penalties. Safaricom had explained that when using Faraja loans, only the normal M-Pesa transaction charges would apply at the point of sale on the product.

For a 30-day loan cycle, the loan would be due on the 30th day and likewise, the 7-day loan would be due on the 7th day after the loan is given.