Capital Markets Authority (CMA) Friday approved Kenya’s first real-estate investment trust (REIT) to be issued by Stanlib Kenya.

Stanlib Kenya is now set to issue an initial public offer for investors to subscribe to units in the new Fahari I-Reit scheme.

The Stanlib REIT scheme seeks to raise a minimum of Sh2.6 billion and a maximum of Sh12.5 billion.

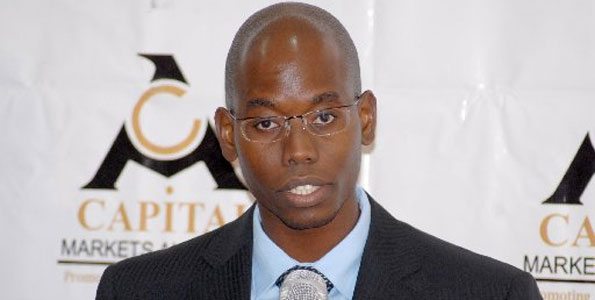

“The approval of Stanlib Fahari I-Reit marks a fundamental step towards efforts to deepen and develop the capital markets by facilitating diversification of products available in the market,” CMA acting chief executive Mr Paul Muthaura said in a statement.

STEADY INCOME

It is expected that the Stanlib Fahari I-REIT will give local investors an opportunity to participate in the real estate sector in Kenya at an affordable price.

The REIT scheme will provide unit holders stable cash inflows from the income generating real estate properties.

The unrestricted IPO will be listed on the main investment market segment of the Nairobi Securities Exchange.

HOW IT WORKS

A real estate investment trust is established for collective investment in the sector with an aim of earning profits or income as trust beneficiaries.

Under the instrument, investors contribute money or buy units in a similar manner to share buying in exchange for rights or portion of the income generated by a portfolio of real estate.

Persons investing in a REIT, like shares, do not have control over the day-to-day management.

The assets are managed by a licensed REIT manager.