Equity Bank’s recent entry into Kenya’s mobile telephony sub-sector has disrupted the market share of traditional mobile service providers. This is as the bank shares the spoils in a crowded market.

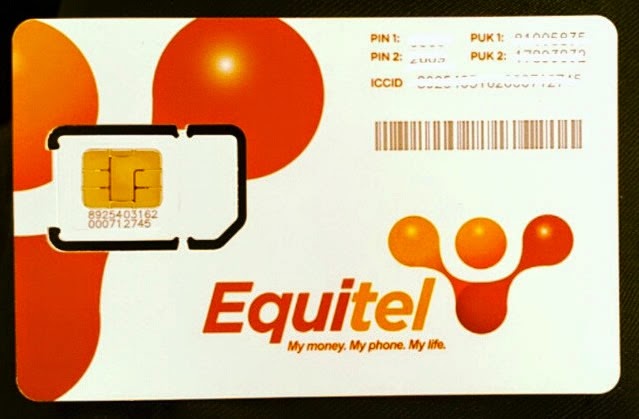

According to the latest data from industry regulator, Communications Authority of Kenya (CA), Equity Bank, through its subsidiary Equitel, currently commands a 1.9 per cent market share.

“The market share for mobile subscriptions registered during the third quarter of the 2014/2015 financial year showed slight changes following entry into the market by Finserve Africa Ltd (Equitel) in the previous quarter,” stated the report in part.

“Airtel Networks Ltd lost 2.4 percentage points market share to record 20.2 per cent, down from 22.6 per cent posted in the previous quarter.” Market leader Safaricom saw its market share decline marginally by 0.3 percentage points to stand at 67.1 per cent during the period under review, down from 67.4 per cent share reported during the last quarter.

Telkom Kenya, however, registered a marginal 0.8 per cent gain to see its market share hit 10.8 per cent, up from 10.0 per cent recorded over the last quarter.

The latest sector statistics come exactly two weeks after Equity Bank announced it will start offering voice and data services through its new Mobile Virtual Network, Equitel. Running on an infrastructure sharing agreement with Bharti Airtel, Equitel provides voice calls at a standard Sh4 across all networks and Sh1 for Short Messaging Service (SMS). Data from the CA report states that Kenya’s mobile service providers continue to lose out to free messaging apps like Whatsapp.

“Short Messaging Service (SMS) traffic declined by 11.8 per cent to record 6.5 billion messages, down from 7.4 billion messages sent during the last quarter, with each subscriber sending an average of 63 messages per month during the quarter,” indicated the report. The entry by Equity into the voice and data segment has been seen as encroaching into market leader and East Africa’s most profitable company Safaricom’s turf.

Equity Chief Executive James Mwangi maintained that Equitel will maintain its strong presence in the banking sector which is it’s core business even as it seeks to build a strong mobile network. Safaricom last year posted more than Sh21.1 billion in pre-tax profits the half-year to end-September, with a bulk of the growth generated from M-Pesa and data services.

The company generated Sh15.6 billion from M-Pesa alone during the same period, a fact that has led several players in and outside the industry to call for the Government to declare the company dominant.