In December 2020, Equity Group crossed the Sh. 1 trillion valuation threshold. This was after it successfully acquired Banque Commerciale Du Congo (BCDC) in a move that set it on stage to compete for big-ticket financing deals on the continent.

Equity Group chief executive officer Dr. James Mwangi said the Sh. 1 trillion balance sheet put the lender ahead of all banks in east and central Africa in asset value, helping improve its visibility to international investors.

“We are delighted to witness this milestone that has shattered the psychological barrier of a trillion-shilling balance sheet,” Dr. Mwangi said.

Equity banking subsidiaries would now be in a position to leverage Equity’s strength to extend large corporate loans across all the countries where Equity operates.

“The one-trillion shilling mark by Equity lifts the visibility of the financial sector in Eastern Africa significantly to compete favorably with financial institutions in South Africa, West Africa and North Africa for project and development finance,” said Dr. Mwangi.

Since crossing this milestone, Equity has been on a relentless march that has positioned it as one of the most valuable brands to have emerged from Kenya.

According to Brand Finance, Kenya 20 Report for 2022, Equity Bank, whose value grew by 92 percent, leads the pack in the list of strongest brands with an elite AAA+ brand rating and a Brand Strength Index (BSI) score of 90.8 out of 100.

“Equity Bank facilitates online banking with its mobile application EazzyNet which allows customers to use their bank account for online shopping, making transactions overseas, accessing loan options and paying bills via a smartphone. The bank’s versatile service offerings make it a popular choice and a household name across Kenya,” Brand Finance Kenya 20 stated.

This is not so far-fetched. A look at the bank’s financials for the year that ended December 31, 2021 shows an impressive growth in profitability. The bank recorded a 99 per cent profit after tax to Sh. 40.1 billion.

This growth was the result of asset growth to corresponding increase in customer deposits which accelerated to Sh. 959 billion from Sh. 740.8 billion in 2020.

Equity’s profitability journey goes back to 1994 when it registered its first profit before tax of Sh. 7 million.

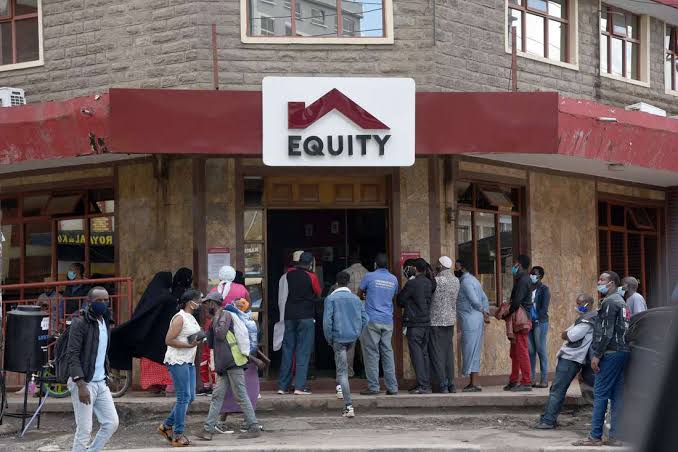

Evidently, there is no lender that has had as far reaching an impact in Kenya as Equity Bank.

Over the past three and a half decades, the lender has not only evolved into one of the most profitable lenders in the region.

It has also taken the lead position as the bank of choice for tens of millions of ordinary individuals and small businesses that were previously considered ‘unbankable’.

This success may have seemed a far-fetched dream when the bank was founded in October 1984. At the time, the bank aimed to provide mortgage financing.

The bulk of Equity’s customers are Kenyans in the small and medium enterprises sector, and the majority of population in the low income cadre.

Unlike the years when Equity had less than twelve thousand customers, the bank now boasts of over 15 million customers with deposits of over Sh. 959 billion.

According to Nairobi-based financial analyst Edwin Muhatia, such a growth trajectory would not have been possible without a formidable back up of banking innovation, technology, and solution oriented products.

“What we have witnessed is a growth centered on technological advancements that have been tailor made to suit the ‘mattress and piggy bank’ customers who were previously shunned by mainstream banks in favour of corporates and the upper working class,” said Muhatia.

Take the “Eazzy” digital banking solution that the bank launched in October 2016. This product made Equity the first bank in Kenya to fully pursue digital banking. The digital banking product includes Eazzy App and Online Banking.

The all-inclusive Eazzy suite of banking products includes the Eazzy App banking application which is downloadable from mobile phones, an inter-operable payment platform dubbed Eazzy Pay, the Eazzy Loan mobile-based loan platform, and Eazzy Chama which is designed to anchor investments and finance management of chamas in Kenya.

Under its Online Banking product, the bank has established the self-service portal, Eazzy Net and Eazzy Biz. Under the Eazzy Net platform, customers are able to manage their bank accounts from the comfort of their mobile phones. When using the Eazzy Biz product, small and medium business owners are able to manage cash and liquidity.

The bank’s loan products that target small business owners have also been a major boost in the sustainability of small enterprises in the current tough economy.

For instance, in September last year, Equity became the newest member of the SME Finance Forum, a global membership network that brings together financial institutions, technology companies, and development finance institutions to share knowledge, spur innovation, and promote the growth of SMEs.

“Our vision is to be the champion of the socio-economic prosperity. Becoming a part of the SME Finance Forum touches on this vision, even as we learn of the latest innovations in SME finance and build our relationship management skills with global leaders in this industry,” said the bank.

But this was just one of the main frontline positions that the bank has taken over the years in promotion of small businesses. In 2015, the bank negotiated and received Sh. 15 billion for onward lending to small and medium enterprises (SMEs) from the African Development Bank.

In February 2019, the bank got Sh. 10 billion from the International Finance Corporation (IFC) to shore up the capital of its Kenyan banking subsidiary and lend to local small and medium-sized firms.

“Our SME funds are tailor made to act as catalyst and facilitate transformation by increasing long-term funding required to allow micro, small and medium businesses to scale up and increase production,” Dr. Mwangi.

Tracing birth and growth of Equity Group into Kenya’s largest bank

Interestingly, according to Muhatia, by leading the pack in technological innovations and product improvement, Equity Bank has been positioning its shareholders for improved gains at the NSE.

“Equity has been one of the few stocks that are profitably and fundamentally strong counters at the local bourse. By going digital, investors who put their money on Equity Group get improved price positions at the market, in tandem with the bank’s improved efficiencies, and profitability from less operating costs,” said Muhatia.