Kenya Airways has explained the process and procedures it follows before acquiring a new aircraft, months after it announced a KSh 51.7 billion plan to modernize its fleet.

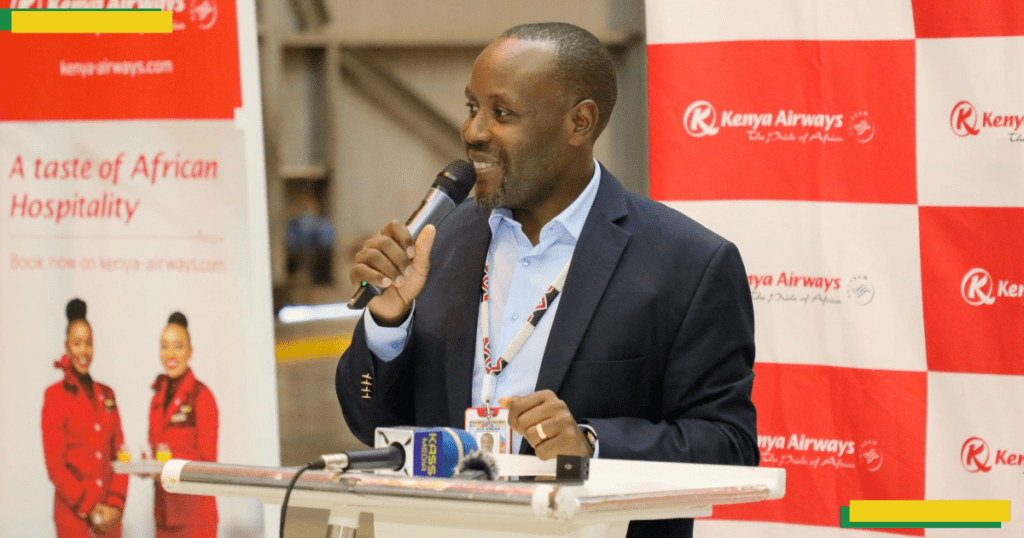

George Kamal, the Chief Operating & Executive Officer at KQ, told Bizna Kenya that growing demand for air travel drives the airline’s decision to acquire new planes. He said new aircraft bring better technology, lower fuel costs, reduced maintenance expenses, and improved operational efficiency.

“Key drivers include growing demand for air travel in the region and the world, occasioning the need to expand our fleet,” Kamal explained during an interview with Bizna Kenya.

Decision process: Boeing or Airbus?

Kenya Airways evaluates aircraft manufacturers through direct engagement with Boeing and Airbus. The airline compares various factors including performance, product mix, and how each aircraft type benefits overall operations.

“This is done through our engagements with both OEMs to understand their product offers, then running a comparison across various key parameters such as performance, product mix, benefits to overall operations,” said Kamal.

International partnerships play a key role in the acquisition process. These collaborations enhance credibility and provide access to additional markets, making it easier to justify the need for more capacity.

Once a decision is made, the airline goes through a strict entry-into-service process. All relevant internal teams participate to ensure the new aircraft fits into existing operations smoothly. This includes training and operational adjustments.

Regulatory requirements

The Kenya Civil Aviation Authority (KCAA) must approve any new aircraft before it can be incorporated into KQ’s operational specifications. KCAA also verifies that the aircraft is airworthy and handles registration.

These approvals are based on certifications from other regulators like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA).

Managing risks and delays

Kamal said KQ constantly monitors market dynamics and adjusts its strategy as needed. The airline maintains regular contact with manufacturers and lessors to adapt to changing conditions.

When planned aircraft deliveries get delayed, which has become common in the industry, KQ evaluates short-term wet lease options. If that’s not viable, the airline optimizes its network to work with the existing fleet.

“The industry is experiencing a big shortage in aircraft. I mean the delays are not in months, not even in one year, in years. You have two or three years delay in production of new aircraft,” said group CEO Allan Kilavuka during the airline’s annual general meeting.

10 clear signs Kenya Airways is turning the corner

Long-term focus despite financial challenges

Kenya Airways’ aircraft acquisition strategy remains forward-looking despite recent financial turbulence. The airline posted an operating loss of Sh 6.2 billion in 2025 compared to an operating profit of Sh 1.3 billion in the prior period and a loss of Sh 12 billion compared to a profit of Sh 513 million reported in the prior period.

Fleet ownership costs increased by 29% following asset remeasurement of leased assets and the addition of one new Boeing 737 aircraft.

The first half of 2025 was marked by operational and financial challenges, including the temporary grounding of three Boeing 787-8 Dreamliner aircraft representing 33% of the airline’s wide-body fleet due to global supply chain disruptions and engine availability constraints.

“The first half of 2025 was defined by industry-wide challenges that directly impacted our performance, particularly the grounding of three of our aircraft. While the financial results reflect these headwinds, we have taken decisive actions to stabilize operations and protect the long-term resilience of Kenya Airways,” said Kilavuka.

On a positive note, one of the grounded Boeing 787-8 Dreamliner aircraft resumed service in July 2025, with the remaining two expected to return to service later in the year.

Kamal said the acquisition strategy looks past current turbulence.

“Our acquisition strategy is forward looking and long term, so we are looking past the turbulence and working towards implementing our plan which we strongly believe will also go along way in improving our financial performance as increased capacity will result in increased revenues.”

The cost of running an Airline

Operating an airline requires significant capital. A new Boeing 787-8 Dreamliner costs approximately USD 248 million (about KSh 32.1 billion at current exchange rates), though airlines typically negotiate lower prices through bulk orders and long-term relationships with manufacturers.

Even seemingly minor incidents carry hefty price tags. Kenya Airways revealed that it lost close to KSh 10 billion due to bird strikes from 2019 to 2024. For 2024 alone, the airline has reported losses amounting to over USD 3,646,405 (Sh 472,330,872) due to bird strikes. This figure is calculated based on the current exchange rate of 1 USD = Sh 129.53. Notably, this loss is nearly the same amount as the airline’s profit for the first half of 2024, where KQ reported a Sh 513 million profit, highlighting the high capital requirements involved in operating an airline.

In 2023, KQ incurred losses of USD 9,017,251 (Sh 1,168,034,278) due to bird strikes. The year prior, 2022, saw damages amounting to USD 6,135,235 (Sh 794,717,235), while 2021 recorded losses of Sh 825,541,886 (USD 6,373,202).

A new engine for a Dreamliner 787 would cost upwards of KSh 4 billion from a supplier like General Electric, which provides engines for KQ.

“If a bird strikes the blades of jet engines, they often break or snap, causing extensive and costly damage to other blades or even the body of the plane. The impact of a bird strike is severe due to the high speed and velocity at which aircraft travel. In some aircraft models, a single damaged blade can cost the airline up to Sh 259 million,” an expert explained to Bizna Kenya.

Fleet expansion plans

Speaking during the airline’s annual general meeting in Nairobi, Kilavuka said the airline plans to grow its fleet from 34 to 53 aircraft by 2029. Funds will be channeled to improve operations, modernize current fleet interiors, install Wi-Fi, and upgrade IT infrastructure.

“We have a fleet plan that talks to increasing the fleet from currently what we have 34 to 53 in 5 years. In addition to that to modernize the current fleet particularly the interior to put you know to install Wi-Fi and all these nice things to make the interior look a little bit more modern. And then also to improve our IT infrastructure. Our initial assumptions we estimate that the full fleet expansion and modernization program is going to cost us between 300 and $400 million,” Kilavuka said.

Before his retirement, board chairman Michael Joseph called for government support in finding a strategic investor. “Finding a strategic investor for Kenya Airlines is not easy. First of all, you look at our balance sheet and you look at the package that’s available. So, we need the government to help us to endorse us to back us in finding a strategic investor.”

Kenya Airways had planned to acquire six Boeing 767s this year but so far only one has been delivered, highlighting the severity of the global aircraft shortage.

Inside Kenya Airways newly leased Boeing 737-800 plane

Innovation beyond aircraft

Kenya Airways recently launched KQSafari Data, a roaming solution designed to provide passengers with affordable mobile connectivity worldwide. The service, developed through the Kenya Airways Open Innovation Challenge and the Fahari Innovation Hub, offers over 2,250 roaming plans in more than 180 countries at lower costs than traditional roaming services.

The National Carrier is betting on its investment plan to help it bounce back from years of financial turbulence. Success depends on securing funding, navigating global supply delays, and finding a strategic investor.