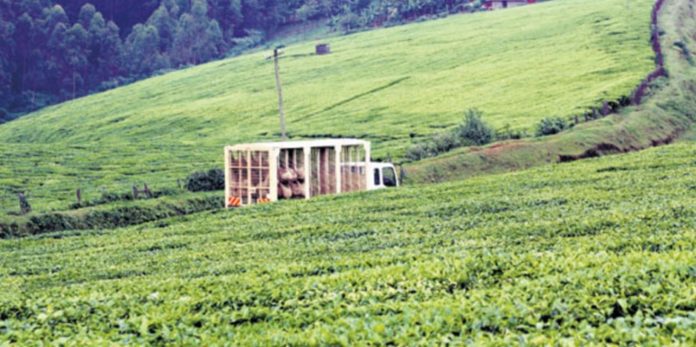

KCB Bank Kenya is set to auction assets belonging to a Kericho tea farm over a Sh1 billion debt that remains defaulted. The bank will auction the assets of Korara Highlands Tea Factory following an approval that was given by the High Court of Kenya.

Korara Highlands currently produces the tea brand that is known as Cyrus Premium Tea. The tea farm had petitioned the court to block the auction arguing that it had found a buyer who would acquire it at Sh1.29 billion.

Korara argued that this acquisition would allow it to settle the debt with KCB without disposing assets. This petition had been filed by the farm’s directors Titus Kigen and Victor Kipkosgei Kigen.

However, the High Court in its ruling determined that the accrued rights of KCB as the lender of the money could not be overridden. The court then determined that Korara had not demonstrated adequate reasons for the injunction that it was seeking.

“The court is not persuaded that [Korara has] demonstrated any patent or fundamental non-compliance sufficient to invalidate the statutory power of sale. Once land is offered as security for commercial borrowing, it becomes a commodity for sale,” the High Court ruled. “Courts cannot rewrite contracts for parties or suspend contractual rights based on hoped-for future arrangements.”

The proceedings in court revealed that the debt owed to KCB had been taken in June 2023. This debt included an overdraft, a term loan, and asset-based finance arrangement, and an insurance premium finance.

These credit facilities had been secured using seven properties that are located in Kajiado and Kericho Counties. As of March 2025, though, the debt owed by the tea farm had ballooned to Sh1.05 billion. Korara was placed under administration in 2025 after running into financial headwinds.

Ol Kalou-based Tower Sacco pays 20pc dividend on share capital, 13pc interest on deposits