Kenya has a burgeoning entrepreneurial culture that has seen many individuals with meager starting capital build successful business empires.

Some of the rich Kenyans we see around have claimed that their business journeys started with less than five thousands Kenyans shillings., and their stories, if true, serve as inspiration to many aspiring entrepreneurs in business.

In this article, we will explore the stories of four rich Kenyans who have publicly stated that they built multi-million business empires with less than Sh. 5,000.

How late tycoon Stanley Githunguri distributed his multi-billion wealth

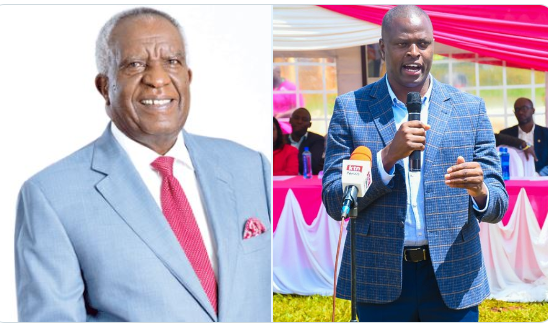

Peter Kahara Munga

Peter Kahara Munga is a well-known entrepreneur and businessman in Kenya, where he has achieved success in the country’s flourishing economy.

He held the position of group chair at Equity Bank Group, the largest bank holding company on the African continent based on customer numbers, boasting over 9.2 million customers as of June 31, 2014.

Munga is widely regarded as one of the wealthiest individuals in Kenya, with a personal net worth that was estimated to exceed US$100 million in February 2014.

Munga’s journey to success began in 1984 when he founded Equity Building Society (EBS) in Kangema, his hometown located in Kenya’s central highlands.

Kenyan billionaires who founded popular Broadways bread business

With a meager starting capital of about Sh5,000, he was able to convince the Kenyan government to grant him a license.

However, by 1993, the society was insolvent, with losses of Sh5 million per year and total losses of Sh33 million.

Munga hired James Mwangi, then 31 years old, as CEO of EBS, and together they turned the society’s fortunes around. Mwangi, who had been appointed director of finance, implemented changes that led to a slow but steady turnaround.

In August 2004, EBS was transformed into Equity Bank and two years later, it was listed on the Nairobi Securities Exchange (NSE). The lender has since re-branded as Equity Group Holdings Ltd, serving customers across the East African region.

In 2022, Equity Group recorded a 36% increase in half-year profit, reaching Sh24.4b.

Paul Kinuthia

Founder of the makers of Nice & Lovely beauty products, Paul Kinuthia, achieved a major milestone last month with the closure of a multi-billion-shilling deal.

The deal involved the sale of Interconsumer Products’ health and beauty arm to French cosmetics giant L’Oreal.

Interconsumer was founded by Kinuthia in 1995 with a modest sum of Sh3,000. He started by producing shampoos and conditioners, which he sold to beauty salons.

Despite facing many challenges, Kinuthia persevered and slowly built the company from the ground up.

Starting with manual production machines in a small and dusty room along Nairobi’s Kirinyaga Road, Kinuthia’s dedication and hard work propelled the firm to become a household name in the beauty industry.

The company’s turnover in 2012 was reported to be approximately Sh1.64 billion.

Ndindi Nyoro

Kiharu MP Ndindi Nyoro’s entrepreneurial journey started at a young age when he set up a kiosk outside his home in 1997.

However, his father advised him to focus on his education, leading to the closure of the business. Nevertheless, Nyoro’s passion for entrepreneurship remained, and he used his pocket money to start small businesses while in school.

Ndindi Nyoro: This is why saving money will not make you rich

His most significant ventures include Afrisec Telecoms, Investax Capital, and Stockbridge Securities, with a combined net worth of over 100 million.

Nyoro is also the largest individual shareholder at Kenya Power and Lighting Company (KPLC), owning 27.3 million shares as of June 2022.

Nelson Muguku

Nelson Muguku was the largest individual shareholder of Equity Bank at the time of his passing, but his journey to becoming a billionaire had humble beginnings.

In the 1950s, his most prized possession was a bicycle.

Born in 1932 in Kanyariri Village, Kikuyu Division of Kiambu District, Muguku learned entrepreneurship from his father, Njoroge.

His quest to become a successful entrepreneur began when he left his college teaching job, with just Ksh 2,000, two hens, and one cock, against the wishes of his parents and the ridicule of his white boss.

In 1965, Muguku expanded his farm by purchasing a 22-acre land parcel from a Mzungu veterinary doctor for sh 100,000.

He renamed the farm Muguku Poultry Farm and installed a 9,000 egg incubator. At one point, he even supplied eggs to Kenya’s founding president, Mzee Jomo Kenyatta. The farm now boasts of over half a million chicks and hosts dairy cows and an orchard.

With his earnings from the poultry business, Muguku invested in Equity Group Holdings, buying a 6.08% stake before it was listed on the Nairobi Securities Exchange (NSE). In 2014, he reduced his stake to 0.9%, which was worth sh 2 billion at the time of sale.

He passed away in 2010, leaving behind a multi-billion empire to his family, including several buildings in Nairobi and Kikuyu.

The Muguku family invested sh 2.6 billion to construct the Waterfront Karen Mall in 2014.

Additionally, Muguku founded Kidfarmaco and Kikuyu Township primary schools and Greenacres High School, making significant contributions to the education sector.