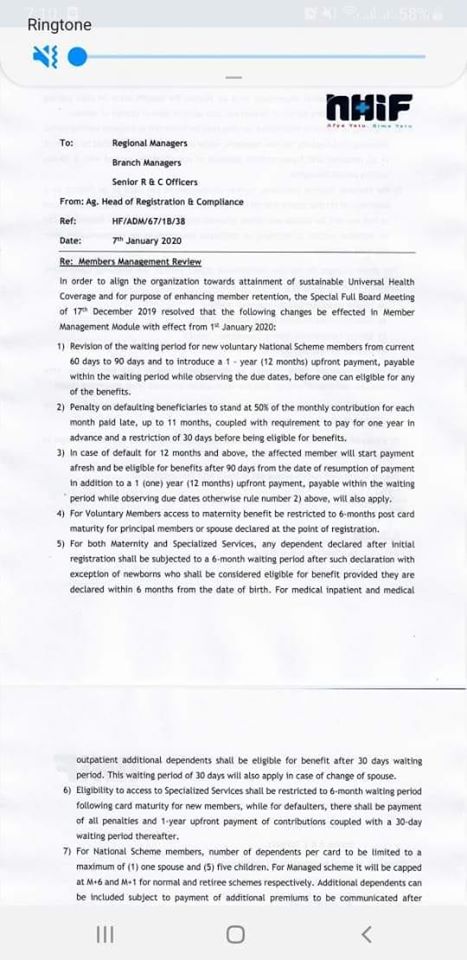

NHIF Requirements: The National Hospital Insurance Fund (NHIF) has released fresh punitive rules for its members.

According to the report, the NHIF has increased from 60 to 90 days the number of months newly registered members will have to wait before they access service.

At the same time, new members will have to pay one year premiums in advance within the 90 days in order to access NHIF services.

NHIF receptionist who bought Sh. 210 million houses

Penalty for late remission of contribution will be 50 per cent of the outstanding amount. The rules also show that a member who is in arrears for more than six months will have to clear the arrears and pay one year in advance. Also, such a member will have to revert back to the waiting period of 90 days.

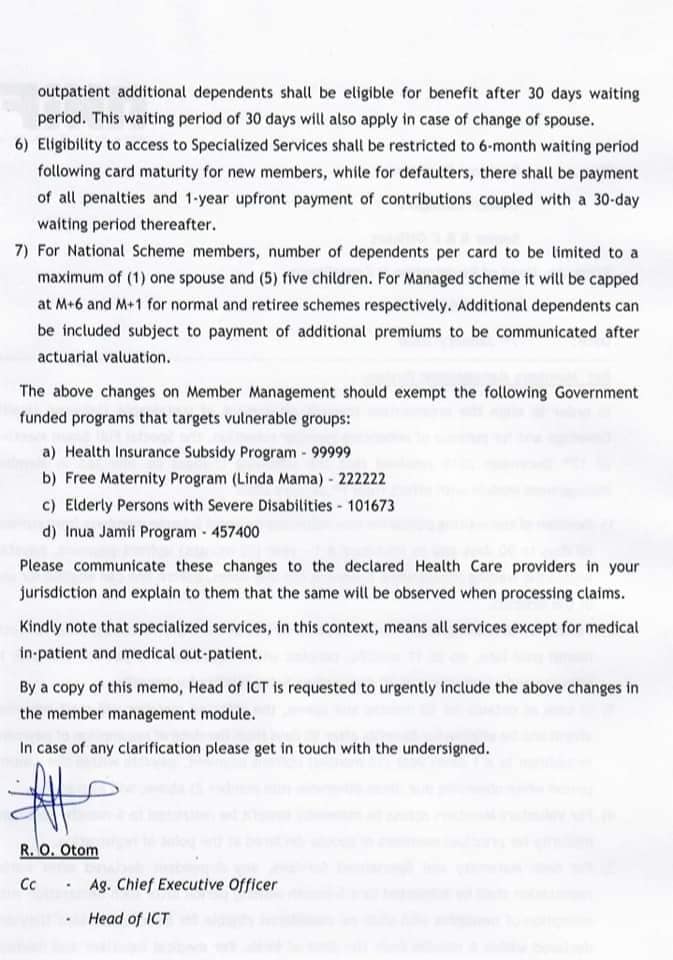

These tough NHIF requirements and rules are contained in a leaked letter that was addressed to all regional managers by the acting head of registration and compliance.

The new rules are set to rub the majority of Kenyans who rely on NHIF the wrong way. Already, Kenyans have been complaining that the benefits of having an NHIF subscription are only limited to civil servants. Outpatient and Inpatient services have been largely limited as well, with the NHIF taking part of the lower end bills such as hospital beds.

“Universal health coverage (UHC), ENSURES that health services DOES NOT expose Kenyans to financial hardship. NHIF wants to introduce upfront payment of (1) year before someone can be eligible to any benefits; How can this enhance UHC? One of the key element of UCH is to reduce social inequities. When you impose such ridiculous terms, How do you accommodate Jua Kali/low social class people who can only afford monthly payment? NHIF wants poor Kenyans STRUGGLING to get Ksh. 100 a day, to pay Ksh. 6000 at once then again wait for 90 days before they can enjoy free healthcare. This UHC you are Joking with can only be achieved by providing affordable option for Kenyan’s poorest. It talks of financial protection; poor/ vulnerable people should have access to the health services they need without ANY restrictions. It’s of my view that to achieve UHC for all, NHIF terms should set based on people’s economic status,” a Kenyan known as Ronald Ngala reacted on the NHIF Twitter handle.