Looming economic depression: Covid-19, climate change evasive measures, high gas prices, and the war in Ukraine have all made a cocktail of economic doomsday for the USA, Kenya, Africa and the world at large. Let’s start with the word depression. There is no commonly accepted definition of the term.

That’s not surprising, given how rarely we experience catastrophes of this magnitude. But there are three factors that separate a true economic depression from a mere recession. First, the impact is global. Second, it cuts deeper into livelihoods than any recession we’ve faced in our lifetimes. Third, its bad effects will linger longer.

A depression is not a period of uninterrupted economic contraction. There can be periods of temporary progress within it that create the appearance of recovery. The Great Depression of the 1930s began with the stock-market crash of October 1929 and continued into the early 1940s, when World War II created the basis for new growth.

That period included two separate economic drops: first from 1929 to 1933, and then again from May 1937 into 1938. As in the 1930s, we’re likely to see moments of expansion in this period of depression.

Will this recession surpass 2008/09, and how quickly can the economy recover?

Draconian lockdowns have followed coronavirus around the world. The priority is to ease pressure on health services and minimize loss of life – so-called flattening the curve. In the worst-affected countries, all but essential businesses, industries and public services are shut, and citizens are advised to stay home. Such restrictions on civil liberties, unthinkable just a few weeks ago, are the new reality.

Never has the global economy been suppressed like this. Lockdowns have a severe impact on economic demand and supply and risk triggering an economic meltdown.

Three signs point to a dismal outlook:

Oil Prices

Russia’s attack on Ukraine and retaliatory sanctions from the West may not augur another global recession. The two countries together account for less than 2% of the world’s gross domestic product. And many regional economies remain in solid shape, having rebounded swiftly from the pandemic recession.

Russia is the world’s third-biggest producer of petroleum and is a major exporter of natural gas. With heavy Sanctions imposed on Russia, logistics of oil and fuel products from Russia will not only be complicated but also expensive.

This will make the Middle-East and Gulf Nations close to a monopoly on the major global energy sources. This will make fuel prices skyrocket until Russia’s sanctions are lifted. For your business, stocking of more products will be more costly as the manufacturing costs of every product will rise.

Oil prices gave up most of their big overnight gains in a wild session, briefly dipping into negative territory after surging above $130 earlier in the session. On Sunday evening, prices jumped as trading began with the market reacting to supply disruptions stemming from Russia’s ongoing invasion of Ukraine and the possibility of a ban on Russian oil and natural gas.

However, prices later retreated, in a move that Rebecca Babin, senior energy trader at CIBC Private Wealth, attributed to comments out of Germany that the nation is reluctant to ban Russia energy imports. The oil and gas terminal at the Port of Odessa in Odessa, Ukraine, on Saturday, Jan. 22, 2022.

“Crude is coming off the highs following comments from Germany saying they have no plans to halt Russian energy imports, indications that the US is exploring replacement barrels from Venezuela and Saudi Arabia,” she said. “Probably the most important take away from the trading action this morning is that this situation is extremely fluid,”

she added.

West Texas Intermediate crude futures, the U.S. oil benchmark, at one point spiked to $130.50 Sunday evening, its highest since July 2008, before retreating. WTI futures settled up 3.2% at $119.40, the highest settle since September 2008.

The Russia – Ukraine Factor

Russia’s attack on Ukraine and retaliatory sanctions from the West may not augur another global recession. The two countries together account for less than 2% of the world’s gross domestic product. And many regional economies remain in solid shape, having rebounded swiftly from the pandemic recession.

Russia is the world’s third-biggest producer of petroleum and is a major exporter of natural gas. With heavy Sanctions imposed on Russia, logistics of oil and fuel products from Russia will not only be complicated but also expensive.

This will make the Middle-East and Gulf Nations close to a monopoly on the major global energy sources. This will make fuel prices skyrocket until Russia’s sanctions are lifted. For your business, stocking of more products will be more costly as the manufacturing costs of every product will rise.

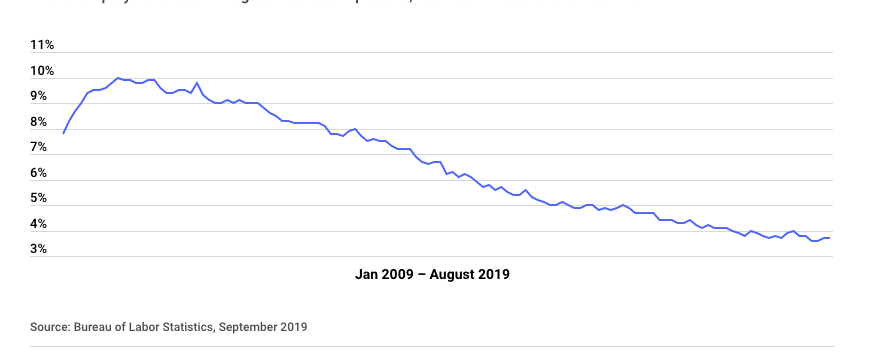

Unemployment Rates

The graph below shows a drop in the employment rates globally since 2019. The graphs and statistics are by Bankrate.com

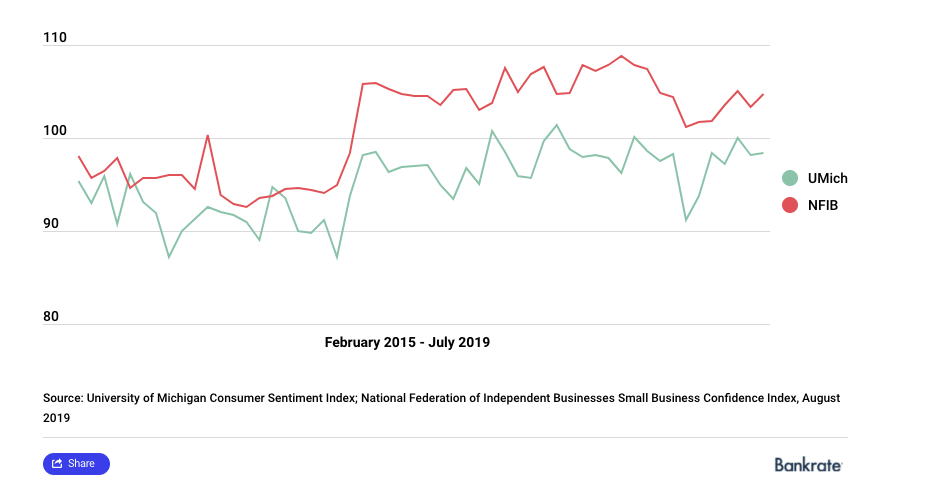

Confidence Indices

Confidence for borrowers and lenders both on a macro and micro level has been on a fluctuating drop since 2019. Statistics and graph by Bankrate.com

Return to our definition of an economic depression. First, the current slowdown is without doubt global. Most postwar U.S. recessions have limited their worst effects to the domestic economy. But most were the result of domestic inflation or a tightening of national credit markets. That is not the case with COVID-19, gas prices and the Russian invasion of Ukraine and the current global slowdown.

This is a synchronized crisis, and just as the relentless rise of China over the past four decades has lifted many boats in richer and poorer countries alike, so slowdowns in China, the U.S. and Europe will have global impact on our globalized world. This coronavirus has ravaged every major economy in the world. Its impact is felt everywhere.

A short, sharp recession, followed by long-lasting damage

Will the policy response enable the global economy to hibernate through the worst of the pandemic crisis then rebound quickly? Unfortunately, it doesn’t appear so. This is not like previous recessions. The near-immediate impact sets it apart — the peak-to-trough contraction will be swift.

The lifting of societal lockdowns will facilitate a surge in growth as economic activity normalizes from suppressed levels. But we expect an economic hangover. According to our high-level recession scenario, global GDP levels might always trail the pre-coronavirus trend.

It goes without saying that many uncertainties remain. Not least, the length of time it takes to bring the pandemic under control. That will determine the duration of the lockdowns and the extent of the economic damage.

Article by: Frank Kiwanuka. Graphs and statistics courtesy of Bankrate.com