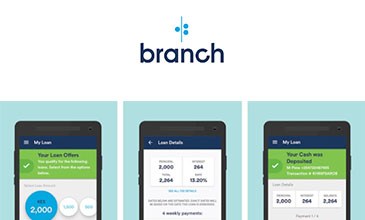

Branch Loan App Download: In Kenya, the Branch loan app is one of the most popular loan application channels that are available on mobile phones.

Branch Loan App Download requirements

The first step is in downloading the mobile app. To do this, you will need:

- An Android or iPhone mobile set

- A valid and active Facebook Account.

- A Safaricom line with an M-PESA Account

- Your National ID Number

How to register on Branch App

To register on Branch loan app:

- Visit Google Play store to download and install the App on your Android Smartphone

- Open the app and log in using your genuine Facebook account. (Branch only allows one branch account per person and the Facebook account you use when you first log into the app is the one we always associate with your account).

How to login for the first time on Branch App

- Select your Country

- Enter your full name as they appear on your National ID card

- Enter your Date of Birth and click next for the next page

On the new page, enter and validate your mobile money account, this should be the Mobile Money account where your branch loan will be sent you should have the SIM card of this number inserted in the phone that you’re using when you’re registering on Branch. The phone number will be automatically validated after a few seconds.

Once you have successfully completed all the steps, you will now be presented with a home screen. Don’t wait any longer, navigate fast to the loans offers page to make your first kill.

How to apply for a loan on Branch App

- On the loans page, there are various types of loan limits you can apply for, for first-time borrowers the loan limit is Ksh 1000 but you can choose to select the Ksh 250 or Ksh 500 offers.

- Choose the loan repayment terms you’re comfortable with. For the Ksh 1000 loan, the loan repayment period is in four weekly repayments.

- Click on the drop-down menu to select a one-month repayment period.

- Click on “Request This Loan” menu button at the bottom of the page.

- A new page will open where you’ll be required to double check your mobile money account. Click on the “Apply” to submit for review.

Charges

- The loan interest rates range from 10 per cent to 27 per cent, with a monthly interest rate of between 1 per cent and 21 per cent.