Co-op Bank Awards Kes 5million to Winners of Akili Kali Innovation Challenge

The Co-operative Bank has this morning awarded a total of Kes 5million to the top four fintechs in the just concluded Akili Kali Innovation Challenge. Of the four winning fintechs, three are operated by Kenyans while the fourth has some foreign interest.

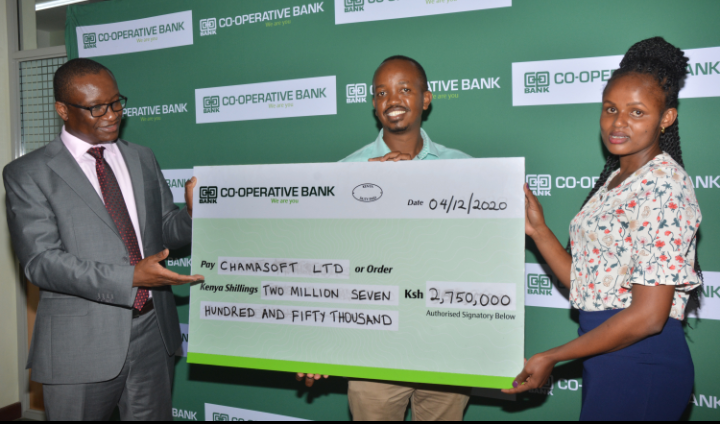

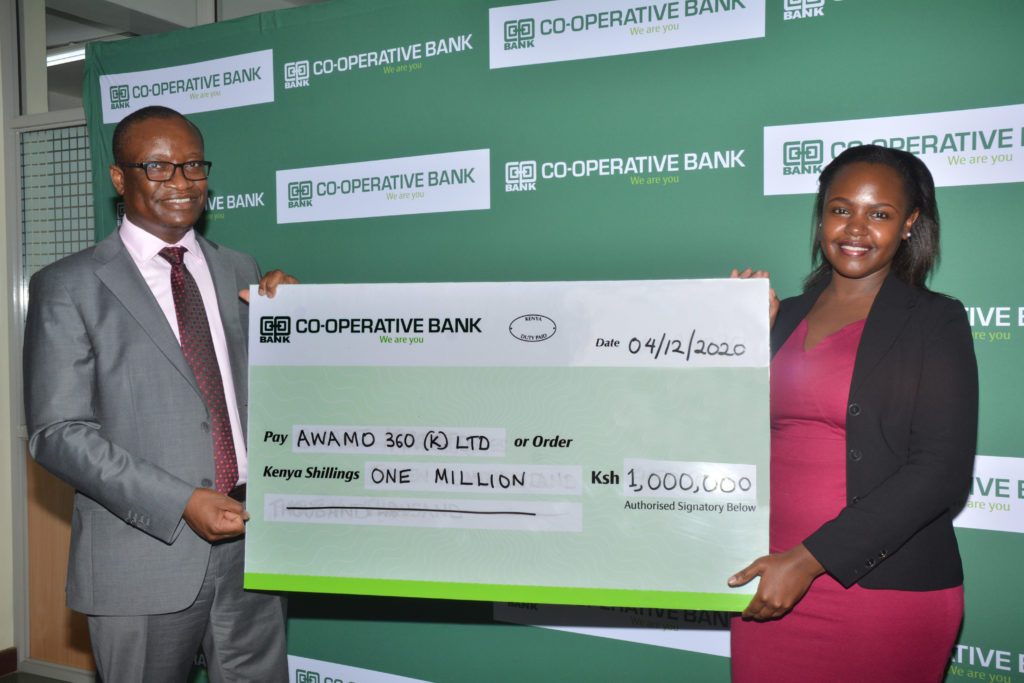

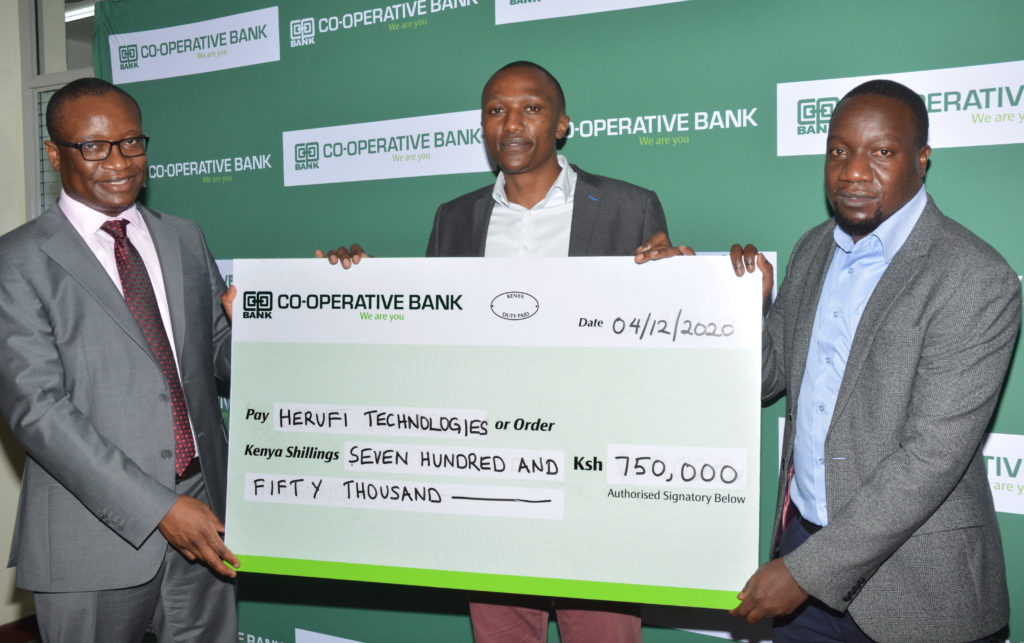

The top four are Chamasoft Ltd, Awamo 360 Kenya Ltd, Herufi Technologies Ltd and Smart Matatu who received Kes 2.75 million, Kes 1million, Kes 750,000 and Kes 500,000 respectively.

The winners were identified following a 5-week co-development program that culminated in an online Demo Day where the shortlisted candidates got an opportunity to showcase their products. The solutions brought forward by the fintechs cut across technologies such as blockchain and AI.

The winning solution – WebSACCO developed by Chamasoft Ltd – will enable smaller SACCOs and Chamas to automate all their operations through cloud accounting, without having to invest the huge amounts of capital that they would otherwise have required to acquire such ICT systems.

SACCOs that choose to utilize the WebSacco platform will move from manual to paperless systems, and have accurate member data which is updated in real time. This will have the effect of enabling members of Saccos to access financial and other value-added services anywhere, anytime, instead of travelling to a branch to fill forms and go through a lengthy manual process.

The aim of the Akili Kali Innovation Challenge, which was supported by the International Finance Corporation (IFC), is to enable Co-op Bank to identify and collaborate with passionate innovators in building the next generation of financial solutions that are beneficial to the Co-operative Movement and its membership of over 15 million Kenyans.

Speaking at the award ceremony, the CEO of Chamasoft Ltd Mr. Martin Njuguna said, “I wish to thank Co-op Bank for leading the way in creating opportunities for Kenyan fintechs to develop practical solutions for local organizations. This whole experience was great for us, and we thoroughly enjoyed taking part in the challenge,” adding that all the participating fintechs should remain engaged with the bank, with a view to helping improve the Akili Kali Challenge and to provide mentoring to future participants.

Co-op Bank’s Director of Co-operatives Banking Mr. Vincent Marangu noted that Kenyan co-operatives continue to enjoy vibrant growth, and should therefore take the opportunity and offer valuable services to both existing and potential new members whose demand for more and better services has grown with the digital revolution.

The five fintechs who participated in the Akili Kali Innovation challenge had been shortlisted from a list of over 500 applicants who responded to a broad call in July 2020. The 5-week co-development program was based on a co-creation model that involved Saccos and Bank officials to ensure the solutions are user-centred and have a business model that the fintechs can commercialize.

Co-op Bank has a long history of driving the digital transformation agenda for the Co-operative Movement, as can be seen in bank’s launch of other technology-based products in the last 10 years including Instant issuance of Visa (Saccolink) cards which enable Sacco members to access their funds from any Co-op Bank ATM or agent countrywide, Pesalink transfers through API integration, a Mobile Banking platform, and remote scanning of cheques which gives Saccos access to the banking clearing house.

About Chamasoft Ltd

The winner – Chamasoft Ltd – is owned 70% by an indigenous Kenyan IT firm called Digital Missions East Africa that has been operating in the digital solutions space since 2005, and 30% by the CEO and IT professional Martin Njuguna. Chamasoft Ltd was incorporated in 2005 to focus on development of Business To Business (B2B) solutions such as WebSACCO and has been engaged in projects in various African countries including Kenya, Nigeria and others.