Tala Philippines: Loan approval takes less than 5 minutes. And you’ll have cash sent to your bank account, Coins.ph wallet, or the nearest padala center within 24 hours.

Tala can give out loans from Php1000 up to Php25000 to be repaid between 21 and 30 days at an interest rate between 11% and 15%.

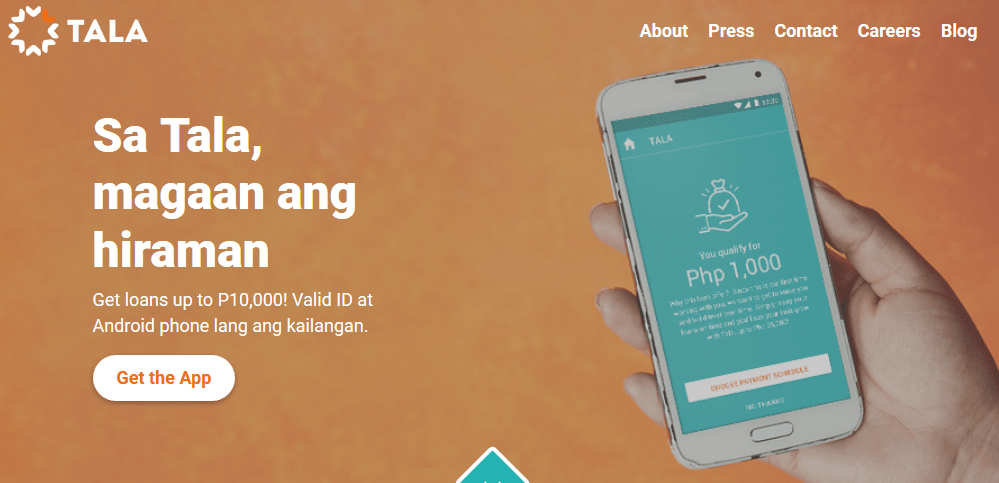

Getting Started with Tala loan app Philippines

You’ll need to have an Android smartphone. There are no app versions for Windows phone and iPhones at the moment.

- Go to play store and download Tala App Philippines

- Fill in the required personal details for example email address, mobile phone number or coins.ph

- Verify your details especially the Phone number

- Set your Tala PIN

How to apply for a loan from Tala App Philippines

- Open the Tala App

- Login

- Select “Apply for a loan”

- Select the amount you wish to take as per your loan limit

- Select duration of repayment

- Select way of cashing out for example; bank account ,coins.ph account, Palawan and Cebuana

- If approved your peso is ready for pick up within hours

How much can I borrow?

• Tala will loan you anywhere from Php 1,000 – 2,000 at first

• You can build your limit up to Php 10,000 by making loan payments on time

• Cash out at thousands of padala center locations, including, Cebuana Lhuillier, Palawan Express, M Lhuillier, LBC, or cash out into your own bank account, or the Coins.ph app

What are my loan terms?

• 21-day and 30-day loan options let you choose what’s right for you

• 21-day loan payment terms have a one-time fee of 11%

• 30-day loan payment terms have a one-time fee of 15%

How do I repay my loan?

• Visit any 7-Eleven, Cebuana Lhuillier, M Lhuillier, or the Coins.ph app

- Pay through remittance agents like Palawan Cebuana,MLhuillier or LBC Pera Padala.

- Pay through bank account depositing