Kenyan investors are redefining the financial landscape by seeking opportunities that align with their aspirations for generational wealth, global exposure, and strategic life planning. Today, investment strategies are no longer confined to local markets or traditional assets. Instead, the focus has shifted to sophisticated, globally diversified solutions designed to optimize returns and secure long-term financial goals.

A New Paradigm for Investors

This shift is fueled by accessibility, as financial service providers introduce innovative products and platforms that open doors to investments once only accessible to individuals with global market access. The rise of digital platforms and mobile applications has further democratized these opportunities, aligning them with global trends and making them more inclusive.

Today’s investors are increasingly tech-savvy, financially literate, and willing to explore a diverse range of investment vehicles. By building portfolios that span asset classes such as equities, bonds, real estate, and alternative investments, they can achieve significant returns while managing risk. For example, global equities and exchange-traded funds (ETFs) provide exposure to dynamic markets in the U.S., Europe, and Asia, fostering both growth and resilience.

Sophisticated Solutions for Wealth Growth

Globally diversified funds, such as Standard Chartered’s Signature CIO Funds launched in 2022 globally, provide an ideal platform for investors aiming to expand their wealth internationally. These flagship foundation portfolios leverage world-class advisory expertise from Standard Chartered’s Chief Investment Office in Dubai and Singapore and market insights to offer tailored foundation portfolios. In September this year, the funds, marked the first $100 million net sales milestone, with Kenya contributing 17% of the net sales a show of confidence from clients on the funds and advisory expertise.

I want to save Sh. 25,000 per month. Which is better between MMF and Sacco?

The Signature CIO Funds are a range of four funds, these four funds cater to different risk or/income profiles and are suitable for investors who are looking to build a Foundation portfolio. As a foundation portfolio for Kenyan Investors, they benefit from: Investment Diversification, Standard Chartered’s Expertise in Fund and ETF Selection and enjoy time savings with Auto Rebalancing by Amundi.

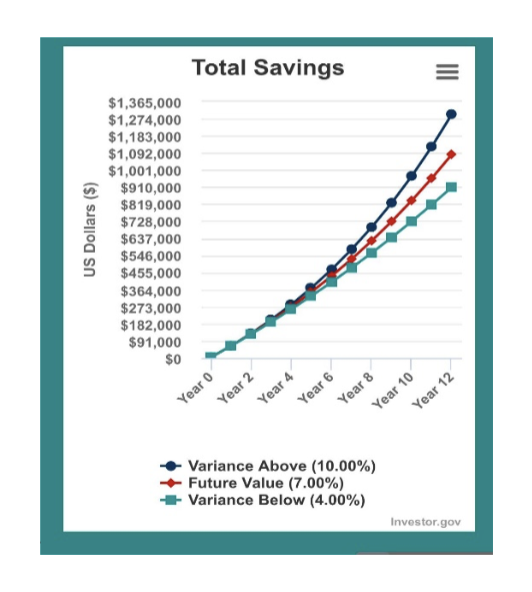

For example, a monthly investment of $5,000 in a diversified portfolio earning 7% per annum could potentially grow to $1,000,000 over a dozen-year time horizon. Such returns empower investors to achieve life milestones whether funding a child’s university education at a top global institution, securing a comfortable retirement, or acquiring international properties.

Building Generational Wealth

Kenya’s investors play a pivotal role in fostering economic growth and resilience. By prioritizing diversification and leveraging global expertise, they position themselves not only as beneficiaries of wealth creation but as contributors to economic development. For those starting their diversification journey, credibility and expertise are key. Solutions that combine transparency, flexibility, and access to global markets often deliver the best results. By leveraging these opportunities, Kenyan investors can secure their financial future while contributing to the country’s economic development.

As financial institutions innovate and offer increasingly bespoke solutions, the potential for investors to grow and protect their wealth has never been greater. The journey toward financial security and legacy-building begins with a proactive approach and a trusted partner. The evolving investment landscape underscores the importance of adapting to change. By embracing diversification, investors can unlock new pathways to wealth creation, foster resilience, and drive sustainable economic growth for generations to come.