Social distancing: The coronavirus pandemic has seen most parts of the world go into a semi lock down – if not a total lock down. The effects of this shut down have not been forgiving to businesses and retailers at all. Many businesses have closed, stock markets have plunged, and the general consensus is that the world will be in a recession by the time the coronavirus pandemic is brought under control across the globe.

Some of the measures that health experts have been advocating as effective in nipping the virus in the bud have included social distancing. This means that even when shopping, customers and retailers are supposed to maintain a specific distance.

In the banking sector, Central Bank of Kenya (CBK) has issued directives requiring banks to quarantine cash for a week to reduce the spread of coronavirus.

Co-op Bank to acquire Jamii Bora Bank in growth drive

“To ensure the virus is not transmitted via cash, all coming from banks will be quarantined for one week,” CBK Governor Patrick Njoroge said. This followed the announcement by the World Health Organization (WHO) that the infectious Covid-19 virus could be carried on the surface of banknotes for several days.

But apart from these hurdles, Kenyans who are working from home or maintaining social distancing have been wondering how they can access banking services without putting themselves at risk. This is because banking services are now at the heart of every day living. To begin with, there are various ways through which this can be done.

Internet banking

Co-op Bank’s Internet Banking is available to all customers of Co-operative Bank with access to a laptop or desk computer that has internet connection, a smartphone or tablet, or a smart TV that can take internet connection. The online service is also available to non-Cooperative Bank customers who are looking to make bulk payments. Whenever you log in, you will be required to enter two passwords. One password is the one you registered with, and the second is a one-time password that you receive through an SMS.

Co-op Bank launches import duty financing for small businesses

Other additional features which you can use include:

1). Pay all your utility bills including Water, pay TV subscriptions, and Kenya Power bills.

2). Order for cheque books or stop cheques.

3). Pay suppliers.

4). Make huge and, or bulk payments. According to Co-op bank, this means that you can pay salaries, disburse loans, or dividends at the same time.

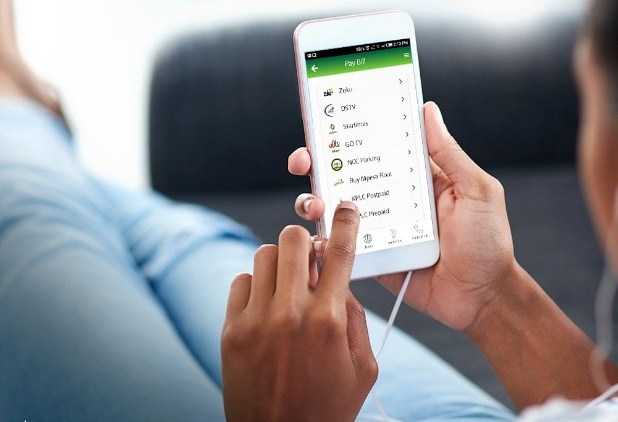

Banking apps

The MCo-op Cash is one of the finest applications that you can use from the comfort of your home. Some of the utility bills you can meet through this app include water bills, Kenya Power bills, DSTV and GoTv subscription, NHIF monthly payments, NSSF, and KRA. Additionally, you can also get a quick loan on this app during these tough times without physically going to the bank. This app will also allow you to send money from your bank account to your mobile phone at no extra cost. If you don’t have this app, you can simply dial *667# on your mobile phone.

Co-op Bank’s full year net profit rises to Sh. 14.3 billion

Visa

If you don’t have these two banking channels, you can still keep the coronavirus scourge at bay by going cashless without incurring any extra charges. Using the Co-op Bank Visa cards, you can shop and pay for items at no extra or hidden costs.